As we enter the holiday season, this may be the first time for some in nearly two years where we are sitting around the table alongside family and friends. The holidays can be a fun time to catch up with loved ones, and one topic that may be up for grabs around the Thanksgiving table is the increased cost of all of the delicious food you’re about to eat! Inflation is the culprit and arguably one of the most pressing issues in the markets today.

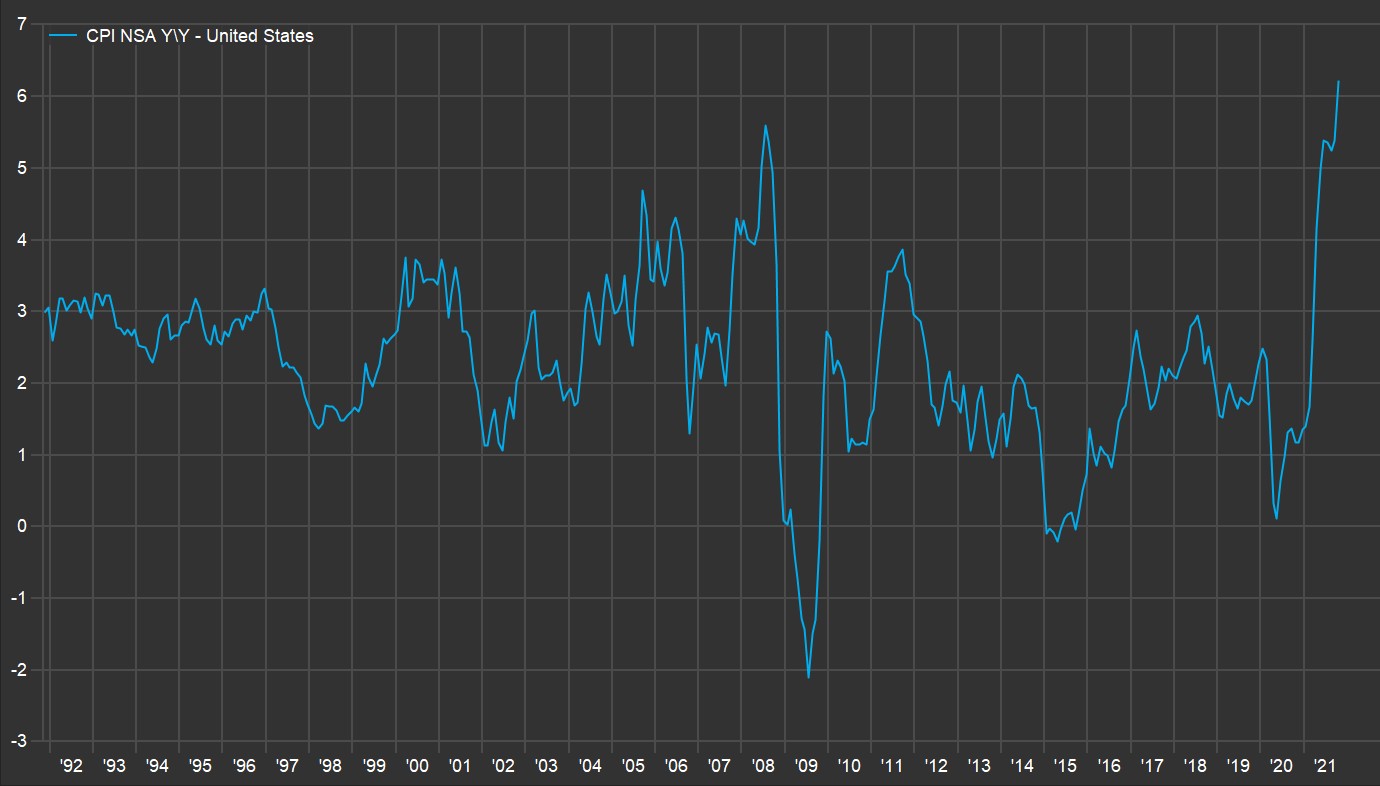

One way to measure inflation is with the Consumer Price Index (CPI), which is a measure of the change in prices paid for a basket of goods. The recent October CPI report highlighted an increase of 6.2% in the Consumer Price Index (CPI), the highest number in 30 years.1

This is likely resonate with many around the dinner table as all have seen first-hand how the costs of groceries, gasoline, heating, clothing, eating out, etc. have risen. In fact, in honor of Thanksgiving, according to Wells Fargo analysis of US Department of Agriculture (USDA) data, the price of a turkey climbed 68% over the last two years, from 81 cents a pound in January 2019 to $1.36 in September. This does not include the increase in prices of all the sides and fixings and the cost to fill the tank to get to your favorite relative’s house.

How did we get here? It certainly is a complex issue with many factors, but when the global economy shuts down for a period of time, it takes a while to truly ramp that back up. In addition, we are dealing with higher than trend line demand and labor shortages.

Click HERE to watch IMG’s Greg DiMarzio, CFA, VP and Portfolio Manager

on CNBC’s ‘Power Lunch’ as he discusses recent inflation numbers

and the market’s ability to ignore current economic trends.

The duration of the inflation we are experiencing has been suggested to be transitory – Transitory: of brief duration; trending to pass away, not persistent. Sounds reasonable, but how long is temporary or not persistent? While this may subside in time, the reality is that we could be living with this level of inflated prices (and tax for consumers) for longer than anticipated. As indicated, one of the major culprits of inflation has been the back up in the supply chain. Most companies we speak to continue to have low visibility on when this issue will materially improve. One of the major implications that has yet to become top of mind is whether this will lead to demand destruction for consumers. At some point, consumers may say “enough is enough”, and curtail their consuming patterns. This will be something to watch carefully as it could negatively impact the economy and subsequently the global markets. On a positive note, while higher than typical inflation may cause near term turbulence, equities have historically been in a good place to combat inflation Market participant’s knowledge of this could further support the markets.

While inflation, consumer spending will likely effect our economy and the global markets near term, we maintain a strong focus on building portfolios and allocations for clients that are structured for the long term and aim to mitigate the inevitable challenges brought forth, including “transitory inflation”.

We wish you and your loved ones a happy and healthy Thanksgiving.

For additional insights from IMG experts,

please visit our website’s Insights page and follow us on LinkedIn.

1 Chart Source: FactSet; US Bureau of Labor Statistics