Investor attention for much of this year has been on the direction of the economy and inflation; understandably so given the magnitude of these issues. However, we are also focused on company fundamentals since over the long term stock prices have a propensity to track earnings. Now that the second quarter earnings season is ending, and as the calendar turns to August, it is an opportune time to assess the fundamental outlook for corporate America over the next 12-18 months.

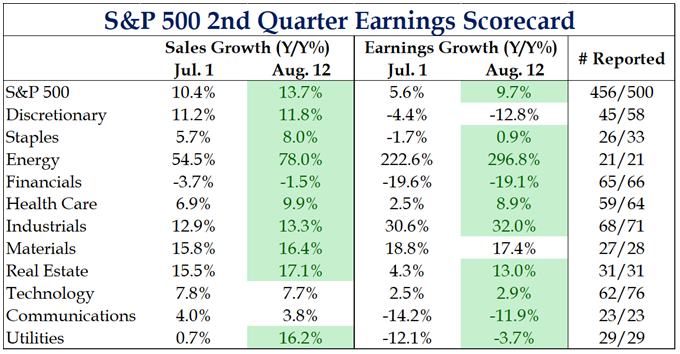

As shown in the table below, S&P 500 second quarter earnings came in better than expected with year to year sales and earnings growth for most sectors beating consensus estimates. More specifically, all sectors except Communications & Technology exceeded revenue growth estimates while all sectors except Consumer Discretionary & Materials beat earnings growth estimates (Strategas). These results demonstrate the resiliency of many companies that have performed well, despite what is a very challenging operating environment.

As shown in the table below, S&P 500 second quarter earnings came in better than expected with year to year sales and earnings growth for most sectors beating consensus estimates. More specifically, all sectors except Communications & Technology exceeded revenue growth estimates while all sectors except Consumer Discretionary & Materials beat earnings growth estimates (Strategas). These results demonstrate the resiliency of many companies that have performed well, despite what is a very challenging operating environment.

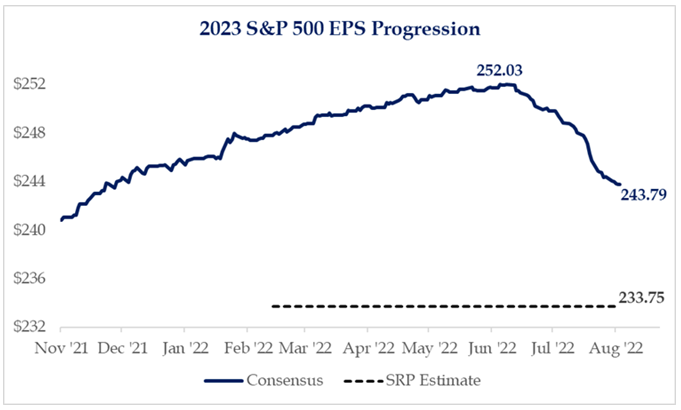

That said, while the operating environment is already tough, there are signs additional challenges may lie ahead. Last month’s Markets & Economy update alluded to the fact that while 2022 & 2023 corporate earnings estimates have remained largely intact so far this year, significant headwinds persist including a slowing domestic economy, lower internationally sourced revenue due to the rising value of the U.S. dollar, higher costs across the board due to inflation, and most recently the passage of the Inflation Reduction Act which establishes a 15% minimum corporate tax rate - all of which may put additional pressure on the corporate earnings outlook. Indeed, whether or not we have a recession, the chart below shows that 2023 consensus S&P 500 earnings estimates have already begun to decline from a peak of $252.03 in June to $243.79 in August (Strategas). This is to be expected as we debate whether we are entering, or are already in, a recession. The stock market is a forward looking indicator and much of the stock pressure in the first half of the year was in anticipation of lower earnings this year and possibly next year.

In conclusion, despite facing numerous challenges, the U.S. corporate sector has held up well so far this year as evidenced by better than expected first and second quarter earnings results. Markets are forward looking, and investors will have their eyes peeled to see if 2023 consensus earnings estimates continue to decline or stabilize and move higher over the course of this year. Stepping back, the economy, inflation, politics, and geopolitical events are no doubt important factors, but they are just some of the many inputs that determine corporate earnings which is ultimately the main driver of market prices over time.

As always, should you find yourself questioning your current situation, concerned about risk or outside factors, our team is always here to navigate you through it and answer any of your questions.