The first half of 2022 exhibited the rare occurrence where both the stock and bond markets experienced negative returns. More often than not these asset classes move in opposite directions, however the quick rise in interest rates, slower economic growth, and persistent inflation have contributed to volatility across most markets. The Consumer Price Index (CPI) data for June rose to a four-decade high of 9.1%.

Not everything is doom and gloom, and it is often helpful to place current events into historical context. Coming up against a pause in the rise of the S&P 500 Index, after it more than doubled in two years, is not a surprise. The index is still over 10% higher than before the pandemic hit in 2020. It is important to remember that the average intra-year decline since 1980 is 14% (J.P. Morgan). What captures the most attention is that markets are down right from the beginning of the year.

Not everything is doom and gloom, and it is often helpful to place current events into historical context. Coming up against a pause in the rise of the S&P 500 Index, after it more than doubled in two years, is not a surprise. The index is still over 10% higher than before the pandemic hit in 2020. It is important to remember that the average intra-year decline since 1980 is 14% (J.P. Morgan). What captures the most attention is that markets are down right from the beginning of the year.

Throughout 2021, consensus analyst earnings estimates (a forecast of a public company’s projected earnings based on the combined estimates of all equity analysts covering the stock) were revised upwards each quarter as results and forecasts proved better than expected. Thus far this year, although the price of the S&P 500 Index is down 20%, the earnings estimates for the year have not declined. However the market might not be as inexpensive as it seems, as earnings estimates face very real headwinds with higher costs due to inflation, and lower revenues due to the rising value of the U.S. dollar (the euro fell below 1:1 parity with the U.S. dollar briefly for the first time in 20 years) may make it difficult for the 2022 and 2023 corporate earnings estimates to remain intact.

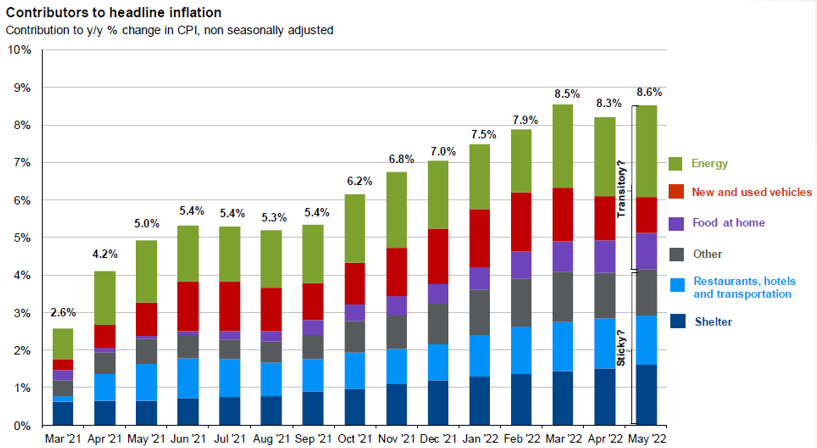

Although inflation hit another 40 year high in June, we may have seen the peak as oil prices are back below $100 per barrel ($122.71 per barrel was the recent high) and there have been signs that automobile prices have begun to soften. This would be welcome news to the investors and consumers who have felt the pain of rising inflation and would provide some reason for optimism that at least one area of economic weakness may begin to improve.

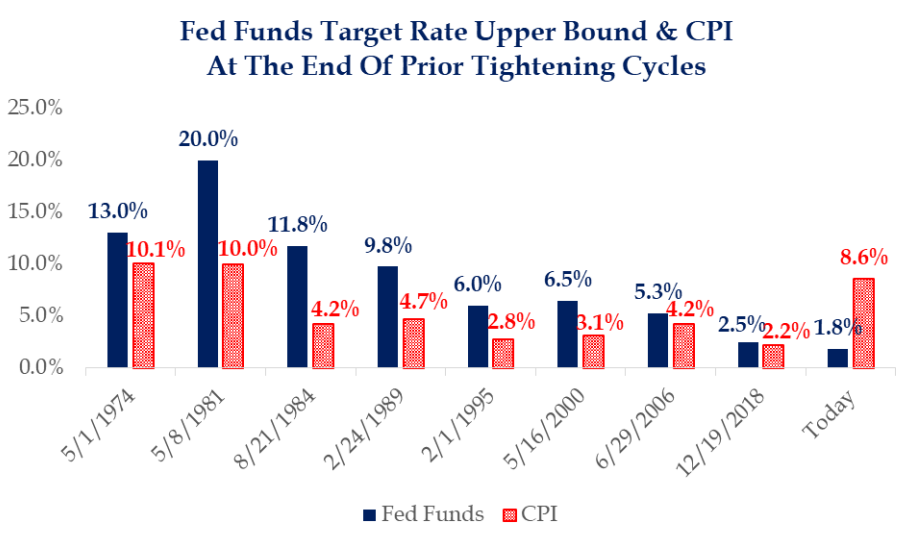

As energy and automobile price increases subside, there remain sticky inflation components which may take longer to decline, particularly shelter, restaurants, hotels, transportation, education, and medical care services. Since higher interest rates may create a less favorable environment for new economic projects, the Federal Reserve (Fed) is attempting to create a soft landing - trying to avoid a recession while reducing strong demand chasing too little supply. This balancing act is why the Fed Funds rate is still less than half of the current inflation readings.

Lastly, a word of caution for those who wish to wait for the Fed to cut rates before feeling safe again. Since the 1970s, the Fed has never reduced rates while the current Fed Funds Rate is below the CPI readings (Strategas).

Those relying on this signal to determine that the equity environment seems more favorable may have to be patient, as the Fed futures currently do not indicate this scenario happening until the end of 2023 at the earliest. However these indicators are volatile and are constantly changing.

As always, when making investment decisions, investors should be reminded to focus on their long-term goals, and not current volatility. Adhering to a well thought-out financial plan is the best strategy for any economic or market environment.

1 Top Chart Source: JP Morgan

2Chart Source: Strategas