It is our fiduciary duty to you, our clients, that we keep you updated and make sense of events that may affect your investment portfolio. One week ago, Russia invaded Ukraine drawing condemnation and punitive sanctions from the U.S. and a substantial portion of the rest of the world. The humanitarian cost of war cannot be measured, and this may cause long-term economic effects to unfold. The events of the past week are negative developments for the world that we can only hope will find a peaceful solution as soon as possible.

In this update we will discuss the market in the context of this geopolitical event and the implications to the stock market. Before discussing that, it’s important to apply context in terms of what will be affected and how it will impact the global economy.

It is important to understand that the stock market was facing uncertainty before this invasion. Russia’s decision to invade Ukraine added volatility to a stock market that was already concerned with inflation and the pace at which interest rates will rise to combat that inflation. At the time of writing this update, the conflict pushed oil prices upward and sent the U.S. stock market plunging, only to see stocks bounce back and drop again — with more volatility likely. Investors are rightly concerned and confused by this.

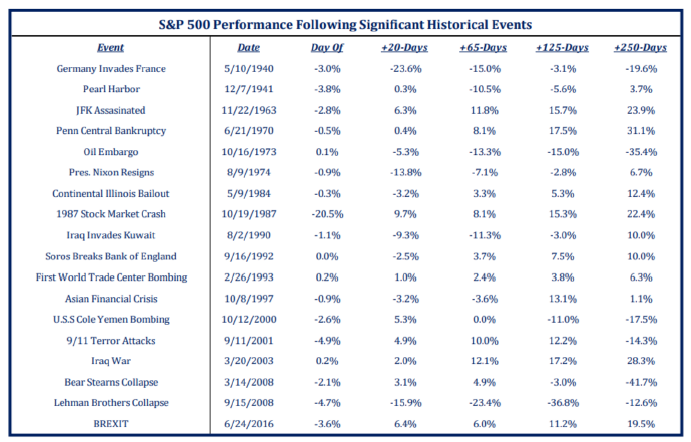

Over time, stocks follow their expected earnings. One thing history has taught us is that the long term impact of geopolitical events to economic earnings tends to be limited (even if significant in the near term). The stock market tends to “look past” near-term volatility. One obvious example fresh in our minds is the stock market’s reaction to the Covid-19 pandemic. Many will recall the very sharp declines in the early days of Covid (late February into early March 2020), but then the subsequent shock when the market rallied as it recognized Covid, while significant that year, would not result in long term negative ramifications for the economy. The chart below1 highlights several significant historical events and their impact on the market, many of which drove the market down significantly on the first day. However, as you can see in the columns to the right, in most cases, stocks were higher in the subsequent periods of time. While we can’t predict the outcome of the market, using this factual data as a benchmark can be helpful in understanding the reaction it has taken in similar situations in the past.

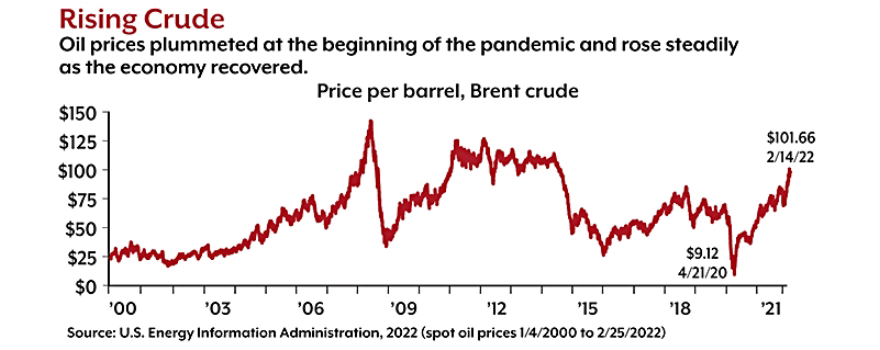

What we have seen since the Russian invasion began is a rapid assessment of where the economic impact may be and the potential significance. Russia’s economy, as well as Ukraine’s, will be heavily impacted and that has been reflected in their stock markets. That being said, their combined impact to worldwide GDP is less than 4%. Where the greater impact lies is in energy production as well as food prices. Russia supplies roughly 10% of the world’s oil. For context, the United States — the world's largest oil producer and consumer — imports only about 3% of its daily oil consumption from Russia, which could be replaced by other sources. Disruption of Russian oil exports would have a significant effect on global supplies and drive prices higher. Although geopolitical events played a key role in recent price movements, oil prices have been rising since April 2020 as the global economy reopened and demand increased more quickly than production. After a 20% drop in global consumption during the first months of the pandemic, oil producers cut back just as demand increased and have struggled to catch up.

Where the greater impact lies is in energy production as well as food prices. Russia supplies roughly 10% of the world’s oil. For context, the United States — the world's largest oil producer and consumer — imports only about 3% of its daily oil consumption from Russia, which could be replaced by other sources. Disruption of Russian oil exports would have a significant effect on global supplies and drive prices higher. Although geopolitical events played a key role in recent price movements, oil prices have been rising since April 2020 as the global economy reopened and demand increased more quickly than production. After a 20% drop in global consumption during the first months of the pandemic, oil producers cut back just as demand increased and have struggled to catch up.

According to the U.S. Energy Information Administration, global production matched consumption in January 2022 and was projected to exceed demand in the coming months, which might pull prices downward.2 However, the Russia-Ukraine conflict could upset the balance. Accordingly, oil prices have risen rapidly as disruptions are expected. Additionally, Russia and Ukraine combined represent about a quarter of global grain exports, and as such, wheat and corn prices have risen dramatically.

Rising oil prices over the last few months have paralleled a period of stock market volatility and seem to be a contributing factor. Despite all of this disruption, how is it that stocks seem to be only briefly effected? And why are stocks down more right now? Prior to this event, it was expected that the Federal Reserve would have to raise interest rates rapidly to fight inflation. Interest rates, or bond yields, have declined in recent days on some level because of the idea that the Federal Reserve may have to slow the pace of rate hikes to offset any economic weakness that may come from this situation. That may or may not come true, but it is a factor the market is constantly assessing.

Global Finance: Kicking Russia Out of SWIFT

Discipline cannot be overrated in life or investing. It is important to reiterate, in times like these, how and why a disciplined process works in portfolio construction and long term investing. It is common, during such volatile times, to find ourselves questioning whether changes are required given the evolving circumstances. With a disciplined process, based on appropriate facts, incremental changes can be the correct course of action to take. However, in terms of discipline, it is important to remember that things like asset allocation and risk tolerance are long-term decisions and, generally, should not change frequently, if at all.

The chart below3 highlights rapid corrections (down 10% in less than a month) during tumultuous historical events. While it may be tempting to panic in the midst of such volatility, in all but one historical scenario that the market was down, stocks were up over the next twelve months. Every time is different and this offers no guarantee, but we do think it highlights necessary discipline and the benefit of a long-term mindset.

While changes occasionally may need to be made to one’s portfolio construction, more often than not it is worthwhile to stay the course. The way we invest and the way we allocate our client’s capital is a long term decision that is intended to serve our client’s well in good times and in bad. While the immediate conflict between Russia and Ukraine may create negative impacts to the global economy, it is always important to make investment decisions based on logic rather than emotions. As always, should you find yourself questioning your current situation, concerned about risk or outside factors, our team is always here to navigate you through it and answer any of your questions.

1 Chart Source: Strategas

2 U.S. Energy Information Administration, 2022

3 Chart Source: LPL Research, FactSet 01/24/2022 *Set to happen today. All indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.

IMPORTANT DISCLOSURES

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.