Do I Need Life Insurance?

Determining if life insurance is right for you is a very personal decision. Although it may seem morbid, an easy test is to consider if someone would suffer financially if you were to pass away. If the answer is yes, then there is a good chance that you should consider life insurance. While there are several different types of life insurance, what they all have in common is that they pay cash to your loved ones upon your passing. This ensures their financial stability even though your earnings have stopped. Life insurance can help your loved ones cover both current and future expenses, including funeral costs, rent or mortgage payments, outstanding debts, college education, childcare expenses, and estate taxes. Some of the people who most commonly consider life insurance include:

- Married or Partnered People

Those left behind often find it difficult to cover daily and future living expenses without a partner’s financial contributions. This is often the case for young couples as well as empty nesters eying retirement. Life insurance can help ensure your surviving spouse or partner maintains the standard of living you worked so hard to achieve.

- Parents

It is estimated that it costs $233,610 to raise a child to age 18, and that figure multiplies if you plan on contributing to your child’s college education. Statistics like this underscore how important it is for parents to consider life insurance. This not only applies to working parents, but also stay-at-home parents whose unpaid contributions to the family would be expensive to replace. Moreover, single parents supporting families on their own may have a keener need for financial protection in the form of life insurance.

- Retirees

Surviving partners often must make do with less Social Security and pension support. They may also have unforeseen funeral costs to cover, which can seriously hamper their finances. Add to that, leaving money to heirs could trigger estate taxes of up to 45%. Life insurance, which is almost always exempt from federal taxes, can be beneficial in any of these situations.

- Business Owners

Surviving family members are often not prepared to take over a business when an owner passes away. The burden is compounded when a business has debts that are backed by assets like the family home. Or a family that wishes to continue running a business may need to buy out a partner’s shares. Life insurance can be a financial lifeline in these situations, with many business owners pairing life insurance with a buy-sell agreement that lets the surviving partners buy out the deceased partner’s shares via the life insurance payout.

- Estates Owing Taxes

Changes to the federal estate tax rates (tax on the transfer of property at a person’s death) are underfoot. The Tax Cuts and Jobs Act of 2017 (TCJA) doubled the lifetime exclusion (the amount excluded from any federal estate tax) from $5,000,000 to $10,000,000 adjusted for inflation ($10,000,000 to $20,000,000 adjusted for inflation for married couples). The TCJA is set to sunset (revert back to 2017 law) at the end of 2025, 18 months from now. In 2026, the inflation adjusted exclusion is expected to be around $7,500,000 per person ($15,000,000 for couples), with a 40% tax on any assets over this level.

An estate valued at $15,000,000 and growing that has been shielded from the effects of the federal estate tax could now be exposed to a 40% tax on future growth. A $15,000,000 estate growing at an inflation adjusted 3% over 10 years would create a $2,000,000 federal estate tax. That same estate would be levied a roughly $3,300,000 Massachusetts death tax. For a total tax bill of roughly $5,300,000 which is due 9 months after death.

Even those estates that are lucky enough to remain under that federal estate tax threshold need to be aware of and plan for the state death tax. A $7,000,000 estate would currently be taxed at death by the state of Massachusetts $650,000. The Massachusetts estate tax on that estate growing over 10 years at a 3% inflation adjusted rate of return would balloon to roughly $1,500,000 due 9 months after death.

Many Massachusetts residents move away to tax free states, but property owned in Massachusetts by these now non-residents, will be subject to the Massachusetts estate tax. There are many strategies and planning techniques that can be implemented to help reduce the effects of the tax, but most Massachusetts citizens with an estate over $2,000,000 ($4,000,000 married couple) will owe a Massachusetts estate tax of some sort.

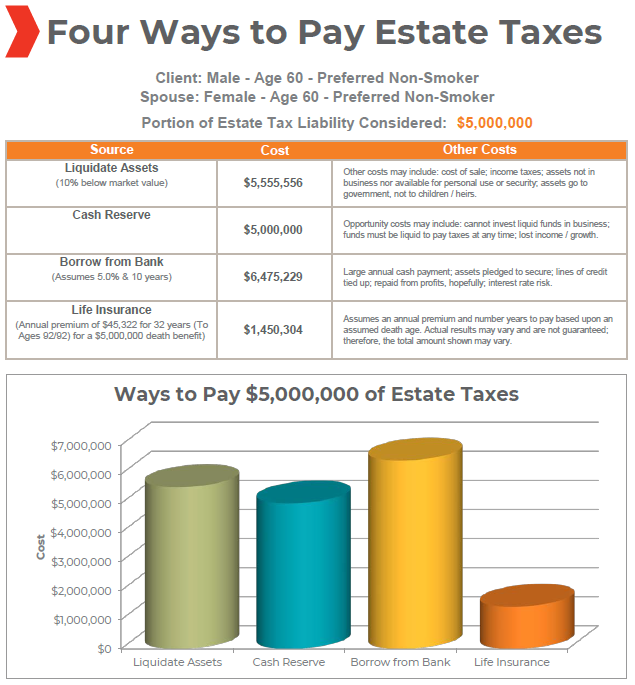

When our clients have potential Federal and/or Massachusetts estate tax exposure, we work closely with them and their tax and legal advisor to help structure a plan to minimize the tax and come up with solutions to help pay the inevitable tax. There are basically four ways of paying the tax. The chart below is a brief example of the four ways to pay a $5,000,000 tax bill. As you can see, one of the simplest and cost effective ways is to gift funds to an Irrevocable Life Insurance Trust where the Trustee would purchase a life insurance policy that would be income and estate tax free. This creates instant liquidity and allows your estate assets to pass to your heirs without forcing liquidation at the wrong time.

Source: Highland Capital Brokerage

Thus, there are many reasons to consider life insurance. The good news is that getting life insurance is simpler and more affordable than most people think. One of the best ways is to work with a licensed insurance agent who can walk you through the entire process. Please reach out to your relationship team if you would like to pursue any of these opportunities.