Happy Fall!

From everyone here at IMG, we hope you had a safe and happy summer and were able to relax and enjoy the longer days. The Olympic Summer Games in Paris were a welcome return to normalcy after the past two editions of the Games took place under the threat of Covid-19, with no or few fans permitted to attend. The commanding performances and stunning victories delivered much needed respite, unity, and collective enthusiasm after the grim pandemic years. Similarly, it seems that interest rate hikes are behind us, a welcome reprieve as inflation may finally be easing to normalcy after the pandemic.

After leaving rates unchanged again in July, the U.S. Federal Reserve (Fed) finally ended its war on inflation at its September policy meeting and cut the benchmark rate 0.50% or 50 basis points to a range of 4.75% to 5.00%. This marks the first reversal since the Fed began its tightening campaign in March 2022. Notably, once the Fed decided it was time to do something about inflation, it moved forcefully, raising rates 11 times from near-zero percent to a range of 5.25% to 5.50%, a 23 year high. Similarly, once the Fed decided that the risk of labor market and broader economic weakening surpassed that of inflation reaccelerating, it opted for a bolder start in making its first rate reduction since 2020 with a 50 basis point cut versus a typical 25 basis point step. The goal is declining borrowing costs, on everything from mortgages and credit card balances to business loans, which will support slower but steady growth in jobs and wages. A majority of the market expects the central bank to cut by another 75 basis points or more before the end of this year.

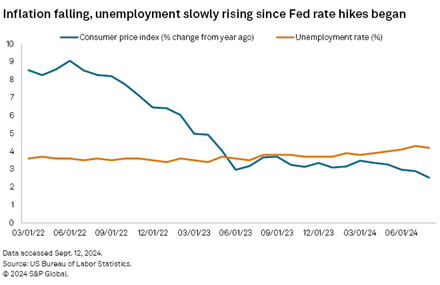

The chart below provides some context:

The consumer price index (CPI), which measures costs of goods and services across the economy, increased 2.4% in September from a year earlier, according to the Labor Department, decreasing from 2.5% in August and 2.9% in July, and extending its cooling streak to six months. Core inflation, which excludes more volatile food and energy, ticked up to 3.3% in September from 3.2% in August, but well below the 6.6% peak in September 2022 and closer to the Fed’s 2% target.

The index for shelter rose 0.2% in September. While this is down from 0.5% in August, shelter costs continue to be a significant contributor to core price increases. U.S. home prices rose to yet another record high in July, although the overall pace of price appreciation slowed. While the number of homes on the market has risen in recent months, it is still nowhere near historical norms. Subsequently, low inventory of homes for sale in much of the country is pushing prices higher, making it especially difficult for first time buyers to afford a home. In turn, many would-be homebuyers are renting for longer than they otherwise may have, which is driving rents higher. According to the Census Bureau, 25.6% of U.S. renters are spending more than half their income on housing.

The personal-consumption expenditures (PCE) price index, which reflects changes in the prices of goods and services purchased by consumers in the U.S. and is the Fed’s preferred indicator of inflation, increased 2.2% in August from the same month one year ago. This marks its lowest annual increase in any month since March 2021 and only 20 basis points above the Fed's 2% goal. Excluding food and energy, the annual core PCE price index increased about 2.7%.

With inflation trending lower, Fed officials shifted their priority to the weakening job market. The U.S. economy added 114,000 jobs in July and the unemployment rate rose to 4.3% from 4.1%, its highest level since 2021. This was significantly worse than predicted and well below the average monthly gain of 215,000 over the prior 12 months. The report sparked worries that the job market is slowing too quickly and could trigger a recession. Subsequently, the U.S. economy added 142,000 jobs in August, 28,000 more than in July, and the unemployment rate ticked down to 4.2%. The August employment report reinforced the view that the U.S. labor market is slowing but not breaking. It also appears that the ‘hard landing’ sell-off in the stock market following the July jobs report was perhaps an overreaction. The pace of hiring picked up strongly in September, adding 254,000 jobs, and the unemployment rate ticked down to 4.1%, signs the U.S. economy had continued momentum in a month the Federal Reserve delivered its first interest rate cut in four years. After spiking in 2020 during the pandemic, unemployment subsided and remained below 4% for 27 months, at or around its lowest in half a century. At 4.1% now, unemployment remains historically low.

Consumer spending continues to fuel solid U.S. economic activity, backed by solid wage gains even as the labor market has slowed. Corporate earnings show that consumers continue to spend, albeit they are increasingly focused on finding a bargain. Still, many Americans remain frustrated about the state of the economy. The Conference Board’s confidence index, which measures consumer attitudes on prevailing business conditions and likely developments for the months ahead, dipped to a reading of 98.7 in September from an upwardly revised 105.6 in August. The decline in confidence underscores consumers concerns about the labor market and reactions to fewer hours, slower payroll increases, and fewer job openings (despite low unemployment, few layoffs, and elevated wages). Conversely, the University of Michigan’s consumer sentiment index, which is used to estimate future spending and saving, increased to finish September at 70.1, its highest level since April. Inflation expectations fell again as the survey showed that consumers were noticing the slowdown in the inflation rate. Mirroring the Fed’s conundrum, consumer sentiment is up with easing inflation, but confidence is down regarding the labor market.

| Asset Class | Benchmark | Q3 | YTD |

|---|---|---|---|

| US Stocks | S&P 500 | 5.89 | 22.08 |

| US Gov't Bonds | Bloomberg US Govt Intermediate | 3.95 | 4.19 |

| Cash | Bloomberg US Treasury Bill 1-3 Mon | 1.36 | 4.08 |

Despite some signs of weakness in the economy, the stock market remained resilient, with the S&P 500 climbing 5.9% in the third quarter, up 22.1% year to date. Utilities (+19.4%) and Real Estate (+17.2%) were the best performing sectors in the quarter, whereas Energy (-2.3%) was the biggest detractor. Falling oil prices on the heels of weak demand and continued recovery in supply weighed on the sector. In a reversal of fortune of sorts, Technology (+1.6%) and Communication Services (+1.7) were bottom performing sectors in the quarter. As an interest rate cut became more imminent, investors trimmed positions in this year’s market leaders and reinvested in shares of smaller companies that are likely to benefit more from lower borrowing costs. All eleven sectors are positive year to date, with Utilities (+30.6%), Technology (+30.3%), and Communication Services (+28.8%) leading the charge. Not surprisingly, artificial intelligence (AI) seems to be the common denominator here. Typically, Utilities perform better when economic growth slows since people cut spending on other items before they stop paying their utility bills. Now, Utilities are poised to benefit from the AI revolution's enormous electricity needs.

In August, the Federal Reserve Chairman, Jerome Powell, formally affirmed the Fed would begin to cut rates soon during his annual speech in Jackson Hole saying, “The time has come for policy to adjust.” A move had been widely anticipated throughout the quarter.

Leading up to the Fed’s September meeting we saw interest rates decline across the curve as investors were split in trying to predict whether the cut would be 25 or 50 basis points. Ultimately, the Fed cut 50 basis points to a range of 4.75% to 5.00%, a pivot from the last two years of policy where the primary focus was to cool inflation. With inflation now nearing the Fed’s 2% target, the new primary focus is to make sure the second half of the dual mandate, maximum employment, is also achieved by not getting behind weak employment numbers.

With the shorter end of the curve more sensitive to Fed policy, the interest rate curve started to steepen as short-term rates began to drop below longer-term rates. Moving forward, the Fed has stated their intention is to normalize rates with gradual reductions; their projections signal two 25 basis point cuts by year end and an additional 100 basis points in 2025. For U.S. credit markets, the expectation of a ‘soft landing’ (taming inflation without triggering a recession) has heightened. Healthy corporate balance sheets have also helped bolster credit spreads (the premium paid over treasuries) which remain tight even with continued strong new issuance.

With declining interest rates both quarter to date (QTD) and year to date (YTD), the overall fixed income market has seen very robust absolute returns across the board. Due to the tighter credit spreads, the U.S. Corporate high yield market was the strongest performing sector at 8% YTD.

Now that the Fed has begun its policy shift, we are seeing yields on money market funds trend lower after yielding near 20-year highs. It can be difficult to time the constantly shifting interest rate curve. Thus, we continue to remind our clients of the importance of building out a portfolio that considers the near, intermediate and longer-term needs resulting in a stable overall income stream.

| Asset Class | Benchmark | Q3 | YTD |

|---|---|---|---|

| US Mid Cap Stocks | Russell Mid Cap | 9.21 | 14.63 |

| Foreign Stocks | MSCI EAFE NR | 7.26 | 12.99 |

| Emerging Markets Stocks | MSCI Emerging Markets NR | 8.72 | 16.86 |

| Managed Futures | Credit Suisse Mgd Futures Liquid | (-3.04) | (-2.21) |

| Global REITs | FTSE EPRA Nareit Developed NR | 16.07 | 11.77 |

| Global Infrastructures | S&P Global Infrastructure | 13.43 | 18.02 |

| Gold | S&P GSCI Precious Metal | 12.33 | 27.47 |

| MLPs | Alerian MLP | 0.72 | 18.56 |

| Emerging Markets Bonds | Bloomberg EM USD Sovereign | 6.51 | 7.98 |

| US High Yield Bonds | Bloomberg US Corporate High Yield | 5.28 | 8.00 |

| Floating Rate Loans | Credit Suisse Leveraged Loan | 2.08 | 6.61 |

| Long Bonds | Bloomberg US Long Corporate | 8.21 | 4.53 |

All diversifying equity asset classes save for MLPs (+0.72) and Managed Futures (-3.04%) added significant value in the third quarter, handily outperforming the S&P 500. From a style perspective, value outperformed growth in the quarter, with the Russell 1000 Value Index up 9.43% versus the Russell 1000 Growth Index, up 3.19%. This reflects the market rotation as an interest rate cut became imminent. However, growth leads value year to date. Excluding Managed Futures, all diversifying equity asset classes have posted positive returns year to date. However, only Gold, surging 27.47%, has outperformed the S&P 500 year to date.

Among diversifying fixed income asset classes, Long bonds, Emerging Markets and High Yield bonds added significant value in the third quarter, whereas Floating Rate loans underperformed on a relative basis.

We expect the Federal Reserve to continue to monitor the labor market closely. Just as it took time for the effects of rising interest rates to work their way through the economy and tame inflation, the same will likely be true for lowering interest rates. We plan to help you meet your long-term financial goals in all environments. Your portfolio has been built to help you achieve your goals over the intermediate to long term.

Sincerely,

David B. Smith, CFA

Managing Director and Chief Investment Officer