After years of working and careful planning, you may find that you have saved more than enough for retirement and potential healthcare expenses. In addition, your financial advisor warns that your estate is large enough that it may be subject to federal and/or state estate taxes at your death. Meanwhile, you have family and friends who may benefit from monetary gifts from you, or you support a charity in need of help. A sound financial plan evolves and adapts to changes in circumstances. As you age, the emphasis may shift from saving and accumulating money for retirement to preserving and maximizing the value of your estate.

Many taxes are unavoidable: income taxes, excise taxes, and sales taxes, to name a few. The estate tax is a tax on your right to transfer property at your death and it can potentially reduce the amount left to pass to family members. However, there are steps you can take now to minimize estate taxation and help you achieve your goals.

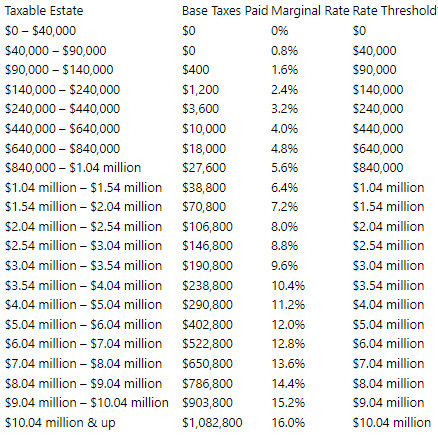

In 2023, the federal estate tax range is from 18% to 40% and will only apply to assets over $12.92 million per person. However, there is an unlimited marital deduction where assets inherited by a spouse are not subject to federal estate taxes; the estate tax will take effect upon the passing of the surviving spouse. In addition to the federal estate tax, 12 states affix an additional tax, including Massachusetts and Rhode Island. Currently, Massachusetts has the lowest threshold at $1 million. This means that once your assets exceed this amount, all of your remaining assets are taxed and the rates range from 0.8% to 16%. Rhode Island’s exemption is currently $1.73 million. Conversely, New Hampshire and Florida have no estate taxes.

Below are the rates in Massachusetts for an estate over $1 million:

Below are some strategies for wealth distribution during your lifetime which will reduce estate taxation:

Qualified Charitable Contribution:

If you are receiving an annual Required Minimum Distribution (RMD) from your traditional IRA, consider donating to a charity via a Qualified Charitable Contribution (QCD). This has the double benefit of reducing your estate, as well as lowering your income during that year. You can donate up to $100,000 per year via this method.

Annual Gift Exclusion:

Gift money or property to your children, other family, or close friends. We advise that you limit your gifts to the annual exclusion amount (currently $17,000 per recipient per calendar year) to avoid having to file a gift tax return. Married couples may gift $34,000. The annual exclusion applies per person, so you can give multiple people up to $17,000 each year. If you gift more than the annual exclusion, you will need to file a gift tax return. You (or your accountant) should track your gifts that are over the annual exclusion amount so that you do not exceed the lifetime gift tax exemption. You can use your federal exclusion during your lifetime and/or at death.

Gifting Low Cost Basis Stock:

Gifting long term appreciated securities can be an effective way to transfer wealth and avoid paying capital gains taxes since the recipient assumes your cost basis and holding period. For example, donating low cost basis stock to charity reduces your estate by the value of the gift and transfers the unrealized capital gains to a tax-exempt entity.

Educational Accounts:

Setting up educational 529 accounts for children, grandchildren, nieces or nephews is another opportunity to gift to future generations while also reducing your estate. If you decide to “front-load” one of these accounts, you may contribute five years’ worth of the annual gift tax exclusion in one year, or up to $85,000, and elect to treat this gift as if you had made it ratably over a 5-year period. This election allows you to apply the annual exclusion equally over the five calendar years. A married couple can donate double that amount.

Irrevocable Trust:

Another option to minimize your taxable estate is to work with your Estate Planning Attorney to create an Irrevocable Trust. Gifting assets to the trust will allow you to set the terms on when and how the beneficiaries would have access to the assets within the trust, as well as remove those assets from your estate.

Other Tax-Free Gifts:

You can make unlimited payments for qualified tuition and medical expenses on behalf of a beneficiary. Payments must be made directly to the school or medical institution to qualify.

These are just some of the many strategies you can utilize now to minimize taxes later and accomplish your goals. Please reach out to your Relationship Manager for a more comprehensive review of your financial and estate plan. Each strategy has tradeoffs that need to be contemplated and understood prior to implementation.