After raising interest rates 11 times since March 2022, the Federal Reserve (Fed) held its benchmark interest rate steady for the second straight month, at a range of 5.25%-5.50%. This marks a 22 year high, and indications are that it may hover around this level for a while. With certificates of deposit (CDs), money market funds, and short term Treasury securities now yielding greater than 5%, some investors may be considering fleeing stocks and bonds for cash and other short term instruments. Whereas a 5% risk-free return seems tempting after a decade of near-zero short term interest rates, investors should not let this upend their long term investment strategy. These cash equivalent vehicles certainly play a role in a diversified portfolio and are a rational place to be for those who have short term cash needs. However, we believe the core principles of investing should not change. The potential gains from a diversified portfolio of stocks, bonds and other investments is the best way to meet your financial goals.

Liquidating your portfolio and moving to money market funds or CDs exposes you to risks which may undermine the perceived 5% risk-free return.

First and foremost, liquidating your portfolio may result in capital gains taxes that reduce the amount left over to reinvest. A capital gains tax is a tax levied on the profit made from selling an asset. Short-term capital gains (assets held less than 1 year) are taxed as ordinary income, whereas long-term capital gains (assets held more than 1 year) are taxed at 0%, 15%, or 20%, depending on your income tax bracket. For example, if you purchased shares in a company for $1,000 and then sold the entire position 15 months later for $1,500, the $500 profit would be taxed. At 15%, this equates to $75 capital gains tax. So, instead of investing $1,500 at a perceived 5%, you now only have $1,425 available. The capital gains impact is determined on a case by case basis, but it is important to recognize the possible tax risk from the outset.

As interest rates rise, prices of fixed rate bonds fall. Thus, by liquidating fixed income securities you may be losing money on bonds not held to maturity since the market price of existing bonds will have dropped as rates have risen. Holding a bond to maturity enables you to get back the par value of your bond, effectively managing interest rate risk.

In addition, even if short term interest rates stay higher for longer, there may be significant reinvestment risk if you do not time the constantly shifting interest rate curve perfectly. Currently, federal funds futures, derivatives based on the federal funds rate that gauge the market’s expectation of changes in the target rate, are projecting cuts in the second half of 2024. If your portfolio is structured to have only short term 2024 maturities and cash, you could potentially be reinvesting your entire portfolio next year at much lower rates. Indeed, if the Federal Reserve does begin cutting rates, then short term Treasury securities and money market funds will be the fastest rates to decline as they are the most sensitive to the Fed’s monetary policy decisions.

Inflation reduces the buying power of cash savings over time and can erode fixed income returns. The future real value of an asset or income stream will be reduced by inflation, and result in a decline in purchasing capacity. Therefore, high inflation of 3.7% undermines the 5% return and reduces spending power to 1.3%.

Perhaps the biggest drawback is opportunity cost. By transferring funds into cash, investors may forfeit potential gains from owning an array of longer term investments. Historically, stocks have higher returns and tend to be more resilient to inflation than cash and bonds. Moreover, continuing to invest in intermediate and longer term bonds now offers an opportunity to lock in current multiyear high interest rates and earn additional income for your portfolio for years to come.

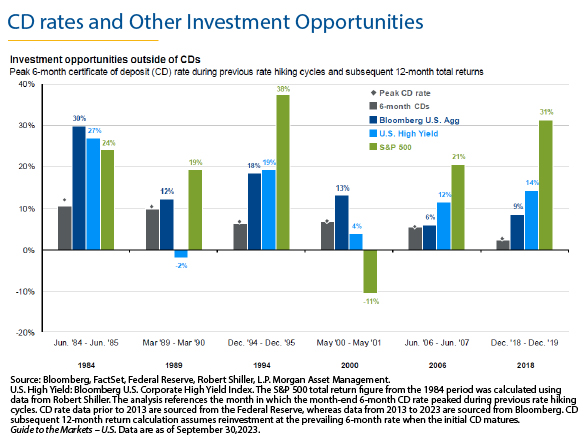

If we look at prior Federal Reserve rate hiking cycles since 1984, cash has always underperformed bonds in the subsequent twelve months. And in all but one scenario, cash underperforms equities as well.

We believe the best approach to building a portfolio is to consider both immediate and longer term needs. We minimize our interest rate and reinvestment risk by utilizing a laddered maturity structure in all of our fixed income portfolios. With this approach, bonds maturing in lower interest rate periods may be offset by those bonds in the portfolio that were purchased when rates were higher, resulting in a more stable overall portfolio income stream.

We mitigate our inflation risk through a disciplined equity process focusing on high quality businesses with strong earnings growth. We have added trusted fixed income and equity diversifiers to our portfolios, with the goal of reducing risk and smoothing returns. This purposeful portfolio construction has worked for us in the past, regardless of the economic, political, or interest rate backdrop, and we believe it will continue to work in the current high interest rate environment. We encourage you to stay the course. Should you have any questions regarding your portfolio design please reach out to your Relationship Manager.