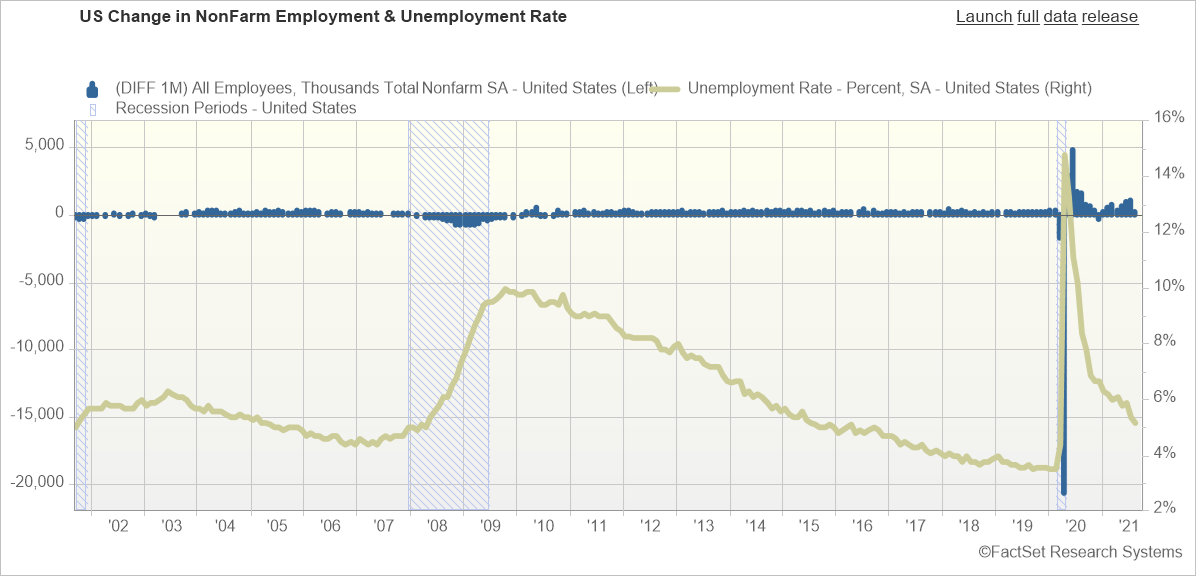

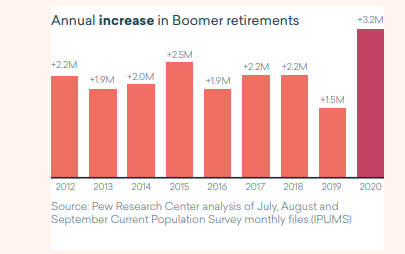

Additionally, part of the answer comes from how the Unemployment Rate is calculated, which includes data only on those who are unemployed and actively looking for work. If someone is not actively looking for a job, then they are excluded in the calculation. This begs the question who is not looking for work and why? There are several groups that fall in this category:

In addition to labor shortages, the economy is experiencing supply chain disruptions both at home and abroad. These disruptions result in higher costs for materials and goods, and delivery delays. Some of these issues come from pent up demand due to the Covid-19 shut down and ongoing Covid-19-related closures, but some are from long standing issues in the economy.

To illustrate the global reach in supply chain disruptions take a textile factory in Asia, for example, that closes due to a Covid-19 outbreak. Then there is a delay in shipping the material and/or they have to pay more in wages to rush the order once they re-open, which would be likely to create increased costs and delays. If those clothes end up in a shipping container that sits on a ship waiting to be unloaded, due to the backlog at the ports which has resulted in increased port fees, it could cause delays and higher costs. Then once they are on shore, the container needs to be driven by truck to the distribution center and then by truck again to the retail stores or directly to people’s houses, but you can’t drive a truck without a driver…which there is a shortage of as well! According to the American Trucking Association, the trucking industry was already short 61,500 drivers before COVID hit. Now that number is closer to 80,000.

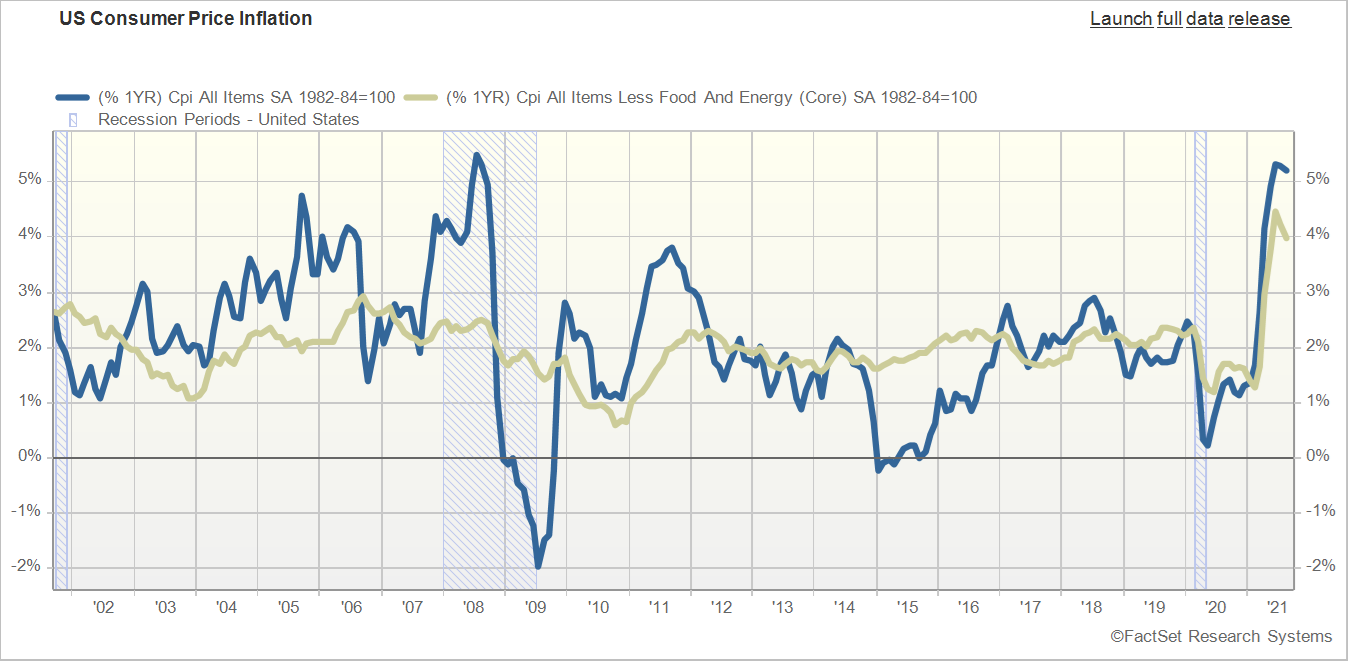

Labor shortages lead companies to increase wages to hire people or pay overtime to cover the gap. These increased costs are passed on to their customers in the form of higher prices. Supply disruptions can cause companies to have higher costs in many ways from paying more to have goods shipped, to delayed orders or shutting down operations while waiting for materials. These increased costs are also passed on to their customers in the form of higher prices.

These higher prices are the inflation we see at the cash register. As a result, inflation has spiked upward.

The Federal Reserve believes inflation is transitory, and if it is not they have stated they will manage it through Federal Reserve Policy.

The labor shortages and supply disruptions should work themselves out over time, some organically and some by creative efforts by smart businesses. We have already seen evidence of these businesses taking advantage of their flexible supply chains adjusting on the fly and keeping production going.

Just as water seeks its own level, so do the markets. The labor, supply and investment markets should all find their own level in the months ahead. Wages and benefits may rise to stabilize the labor markets, the backlogs should diminish as the supply markets find equilibrium, and the investment markets will reward businesses that successfully navigate and take advantage of the opportunities of these times.

For additional insights from IMG experts,

please visit our website’s Insights page and follow us on LinkedIn.