Top Theme of the Month:

Much has been mentioned about inflation recently. January’s report cited a 7.5% annual increase, while the core figure (excluding the prices of food and energy) was 6.0%, both 40-year highs. With crude oil hovering around $90/barrel, it is no surprise that gasoline prices have played a part in the higher figures. Investors have known for some time that prices have been rising, and interest rates would follow. The unsolved questions are 1) has inflation peaked? And 2) what will the new level be when it subsides? The answer to the second question is more important to the level of future interest rates. The 10-year US Treasury yield climbed back above 2% for the first time since 2019, and there are indications that shorter-term yields will move higher as the Federal Reserve ends its bond purchases and potentially raises rates this March.

For more insights from IMG on the topic inflation check out our October 2021 article

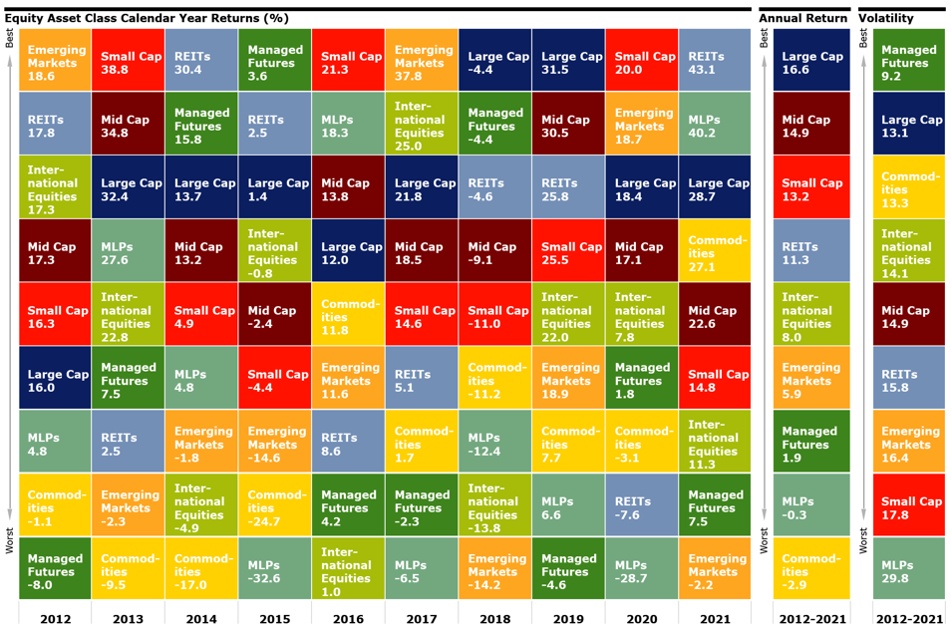

Although investors worry about the stock market when higher inflation pushes interest rates higher, stocks have proven to be a great way to beat inflation in the long-run. What people sometimes forget is that there are other important asset classes besides US large capitalization companies. For example, from 2012-2021, the S&P 500 (dark blue) was the best performing asset class, up 16.6% per year on an annualized basis.1

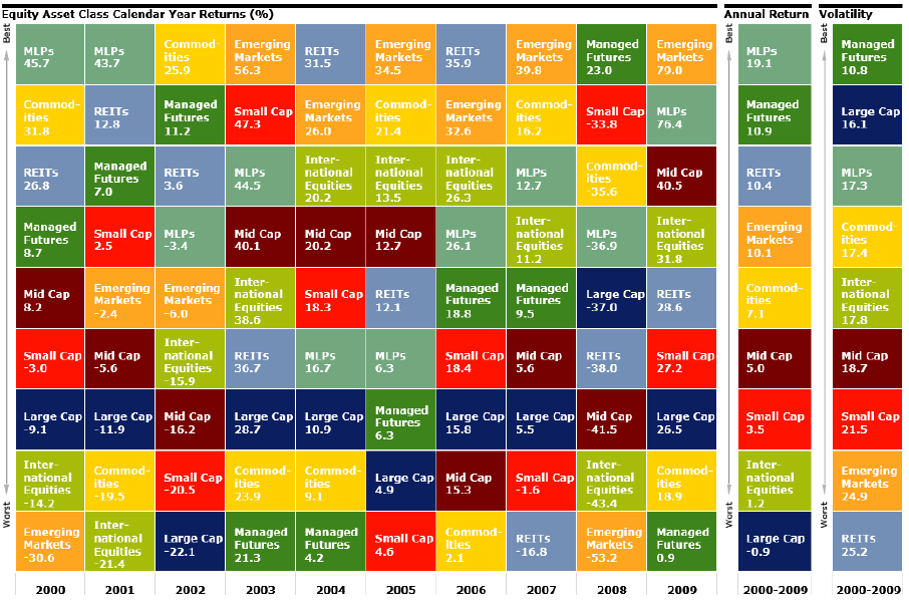

From 2000-2009, however, the S&P 500 (dark blue) was down 0.9% per year on an annualized basis, lagging most every other major asset class.2

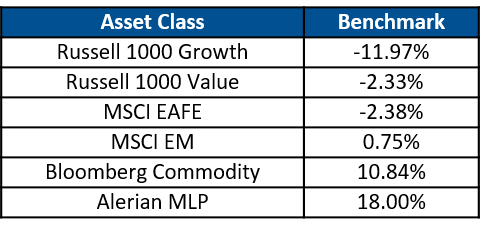

What this tells us is that diversification is important. In addition, year-to-date performance reveals:

No one knows the best-performing asset class beforehand, so it is a good idea to remain diversified to help reduce overall portfolio volatility and provide more stable outcomes. At Rockland Trust, our investment team strives to find the right mix to help you succeed.

The future is always in motion, and can be unpredictable. The best way to prepare for it is to make sure your portfolio is positioned appropriately to help you achieve both your long-term goals while limiting your volatility enough so that you sleep well at night.