As a homeowner, you know home maintenance is inevitable and can be unpredictable – ask anyone who’s needed to replace a water heater unexpectedly.

While some of these projects may not be costly, others can put a substantial financial burden on homeowners who don’t plan ahead or understand their options. The majority (64%) of respondents to a recent Rockland Trust survey reported that they handle home maintenance tasks as they come rather than having a monthly or yearly plan, and 60% reported not having any budget set aside for home maintenance.

Budgeting and planning for these repairs can help ensure you’re in a position to cover any home maintenance tasks or repairs that arise while keeping other personal finance goals on track.

Below, we’ve shared some tips about planning for home maintenance repairs as well as different financing options you can use to keep your home in top shape.

Create a plan for home maintenance and work it into your budget

The best thing you can do for yourself is to come up with a plan tailored to your specific needs and financial situation. If you live in a newer home, you may not need as many routine repairs, while an older home may need more TLC. Some home maintenance tasks may be covered by the dues you pay to a homeowners association (HOA).

Create a plan for possible home repairs – whether that’s monthly, quarterly, or yearly. Nearly two in 10 people who responded to our survey plan maintenance yearly, while 11.7% reported they plan monthly. The frequency depends on personal preference, but the benefit of planning is the same. Doing so gives you the opportunity to see what you may need to cover next.

For example, are you prepared for how a tough winter could impact your pipes or landscaping? Are there appliances in your home that haven’t been running quite like they used to? Does your paint need a refresh? Thinking carefully about the repairs to come can help you pay for them when they arrive.

Once you have an idea of the types of projects that may be in your future, you can estimate costs and decide how to budget around them. In our recent survey, 49.3% of respondents said they have the flexibility in their budget to cover home maintenance needs as they arise. The ability to do so depends on your income, savings strategy, and financial obligations.

How much should you budget annually for home repairs and maintenance?

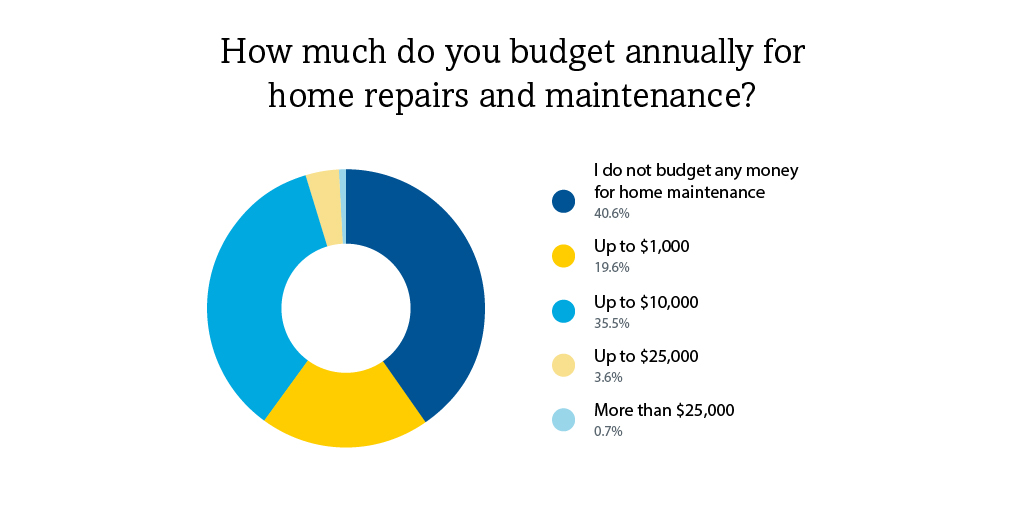

This ultimately depends on a number of factors specific to your unique situation. To give you a sense of how much others set aside, here is what our survey found when asked about how much people budget annually.

Start an emergency fund

Regardless of how you plan, an emergency fund is helpful for unexpected circumstances, like major repairs related to a serious weather event. About 12% of our survey respondents use their emergency funds to pay for home maintenance.

You can steadily build a fund over time — for example, putting even a small portion of your paycheck toward it on a routine basis can start to add up quickly. If your financial situation allows, you might consider one large or several large deposits on an ad hoc basis. Check out our guide to choosing the right type of savings account. Regardless of the method you use, this can help cover you in the event of a serious maintenance emergency or issue.

Consider opening a separate account

Some recommend setting aside between 1% and 4% of your home’s value yearly to cover maintenance. Having a separate account to save your home maintenance-related budget can make it easier to keep track of and pay for repairs. Have a particularly costly project in mind that you want to save for? Download our free savings tracker template to help you visualize progress toward your goal.

Specialized accounting and financing options

Savings or finding room in your budget are not the only funding options for funding. There are several specialized accounting and financing options that can help you pay for home maintenance and repairs, depending on what it is.

For example, a home equity loan allows you to use the equity in your home as collateral to borrow a specific amount of money at a fixed rate and term. Home equity loans can help pay for minor and specific projects or can be part of a larger financial strategy, like debt consolidation.

Another option is a home equity line of credit (HELOC). Unlike a home equity loan, HELOCs are revolving lines of credit that you can draw on. This flexible option allows you to use it when and how you need to. However, they have limits, and we recommend HELOC users wait until they’ve secured approval before starting projects to ensure they don’t overspend.

7 Questions to Ask Before Taking Out a Home Equity Line or Loan

You can also consider refinancing as an option for home maintenance. Depending on your current mortgage interest rate, a cash-out refinance could help decrease your rate while taking care of your repairs. It’s best to work with a lender to understand available options and what might work for your specific situation.

Contractor financing is another option, although terms vary and may not be available through the contractor you’re using. Disagreements between you and your contractor could also make this a challenging option later on — we suggest exercising with care.

7 Questions to Ask Before Refinancing

Credit cards and personal loans

Credit cards and personal loans are other ways to pay for home maintenance repairs, whether expected or unplanned. When we asked survey respondents to describe how they pay for home maintenance, 11.4% said they rely on credit cards or loans. Though credit cards may be tempting because there is no loan origination fee, it’s important to remember that they often come with much higher interest rates. Keep in mind that repairs will go toward your overall balance, and home maintenance projects often cost more than expected.

Personal loans, meanwhile, can offer flexibility and potentially quick funding. However, these loans may have a higher interest rate than other options like home equity loans or HELOCs.

Talk to your team about your home maintenance needs

Home maintenance is an inevitable part of life as a homeowner. Though repairs can sometimes feel challenging, costly, and unpredictable, there are financial strategies to help ensure you can stay on top of these repairs without sacrificing other financial goals and milestones.

You aren’t in this alone. Our team of financial experts can help you weigh your options and decide what fits your unique circumstances and situation. If you already have a home project in mind that you need to save for, download our free savings tracker today to get started.