Purchasing a home is a major financial decision for more reasons than one might think. In addition to the down payment, mortgage, and closing costs, home buyers should be prepared for the maintenance costs that come with their new home.

Whether you’ve already started looking at properties or are still in the early stages of the process, we’ve pulled together some tips to keep in mind so that you can not only purchase a new home but also keep it in top shape for as long as you live in it.

New builds and old homes have different maintenance needs

Some buyers prefer turnkey new construction, while others appreciate the charm of an older home with character. Something important to keep in mind is that different types of properties will require different types of maintenance or repairs on differing timelines, impacting costs.

While it’s the job of a home inspector to find safety hazards, structural issues, and major system defects, these professionals may not find hidden issues, environmental hazards, or problems with specialized systems like sewer systems or septic systems unless included in their scope. This is critical to keep in mind for older homes, as you may find unexpected problems once you move in. You may also want to ask your inspector to add a radon test as they look through the home to ensure you and your family will be safe once you move in.

6 Items for Your New Home’s To-Do List

Consider the home’s age, maintenance history, and any strange noises or odors as you tour properties and weigh your options. This can help you identify costly repairs, such as water damage, foundation problems, plumbing issues, and more, before you decide to buy or close on a home. You may also want to ask questions about when the home’s roof, heating system, and windows were installed, so you can understand what replacement or repair timelines could look like. Additionally, asking about any potential energy-efficient updates that have been made can help give you a full picture of the home’s condition.

New builds, meanwhile, may carry their own costs to make the space feel like home, such as repainting, finishing a basement, or changing out light fixtures and tiling. If you’re searching for new construction, consider what immediate changes you may want or need to make, and build that into your budget or timeline.

Routine maintenance costs can add up quickly

Routine maintenance is just that: routine. In a recent Rockland Trust customer survey, around 80% of respondents reported that they’ve completed routine interior maintenance tasks on their home in the last year, while 75% reported the same for exterior maintenance tasks. About 2/3 of respondents anticipated completing routine interior and exterior maintenance tasks by the end of 2025.

These tasks will look different for each home, property, and homeowner. More frequent maintenance tasks might include anything from changing HVAC filters, checking smoke detectors, and checking faucets for leaks to landscaping and turning outside water on or off seasonally. If your home has a septic tank or relies on well water, there may be other, less frequent, but still important, regular maintenance tasks you will want to account for.

As you budget for home maintenance, we suggest taking careful inventory of your house’s existing condition to understand which routine tasks will likely apply to you. After you’ve spent time living in the home, you can adjust your yearly budget as needed to account for the kinds of maintenance tasks you expect to tackle regularly.

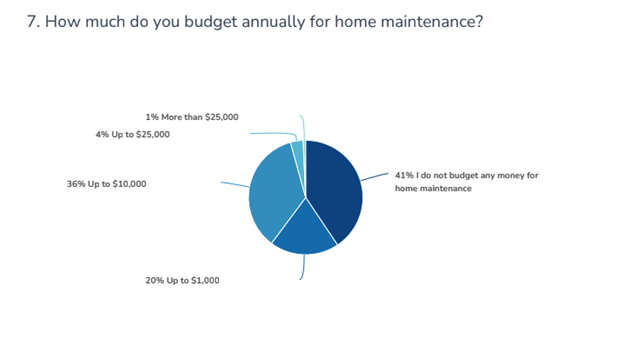

Generally, some advise setting aside between 1% and 4% of your home’s value yearly to cover this kind of maintenance. Below, you’ll find a chart detailing how much our survey respondents budget annually for home maintenance projects.

How you finance routine repairs and other home needs will depend on your unique financial situation and budget. Nearly half of our survey respondents reported that their budget allows them to cover home maintenance costs as they come up. Another option is to set up a separate account dedicated to home maintenance-related costs, which can help with budgeting and help you avoid inadvertently spending that money or dipping into other savings to cover maintenance projects.

Big projects require different financial strategies

Several specialized accounting and financing options exist for bigger projects, like new appliances or renovations, depending on the specifics of the situation. For example, a home equity loan may help you finance a major renovation project with a fixed or known cost, like a kitchen or bathroom remodel, or other improvements that can help increase the value of your home. Home equity lines of credit are another option for home renovations, and can be useful as a safety net in addition to an emergency fund.

Financing Home Maintenance: A Guide for Homeowners

Understanding your options for larger projects — whether planned or unexpected — can help you fold home maintenance costs into your overall financial strategy, providing extra support that allows you to stay on track for other financial goals.

Emergency funds can save the day

No matter how well you plan, the reality of owning a home is that things happen. You may find yourself dealing with a busted water heater, weather-related problem, or another unexpected event that requires attention beyond your planned home maintenance budget. An emergency fund can play a critical role in your ability to cover a repair without sacrificing other important financial priorities.

Whether it makes more sense for you to steadily build your emergency fund over time or to make less frequent, larger deposits, having a savings strategy can help cover you in the event of a serious problem. You can take a look at our guide for choosing the right savings account to better understand which options make the most sense for your financial situation. Our knowledgeable bankers at your local Rockland Trust branch are also available to help answer questions about the benefits of different types of savings accounts.

Strong planning can help you achieve your dream home

No matter where you are in your homebuying journey, planning ahead can make many aspects of homeownership easier. Understanding what your routine maintenance will look like, budgeting for larger issues or one-time projects, and setting aside money for emergency repairs are all parts of what it means to own a home.

While that may feel daunting, you’re not alone! Our team of financial experts can assist you in finding the right financial solutions based on your specific circumstances.

If you’re thinking about buying a home and not sure where to start, our free Homebuyer’s Playbook offers expert tips for each stage of the process. Download your copy today!