Love is in the air, and so are credit card transactions. Let’s face it – wedding season is expensive — the global wedding market was reported at $21.43 billion in 2022 — and it can be challenging to navigate balancing a budget in preparation for the big day, whether you're in the wedding or simply guest.

But what is the right amount to spend on a gift? Does it depend on who’s getting married? There are so many questions and variables that surround the “proper” financial etiquette for weddings, so we decided to ask you for your take on it. Check out the questions, popular responses, and financial tips from our team!

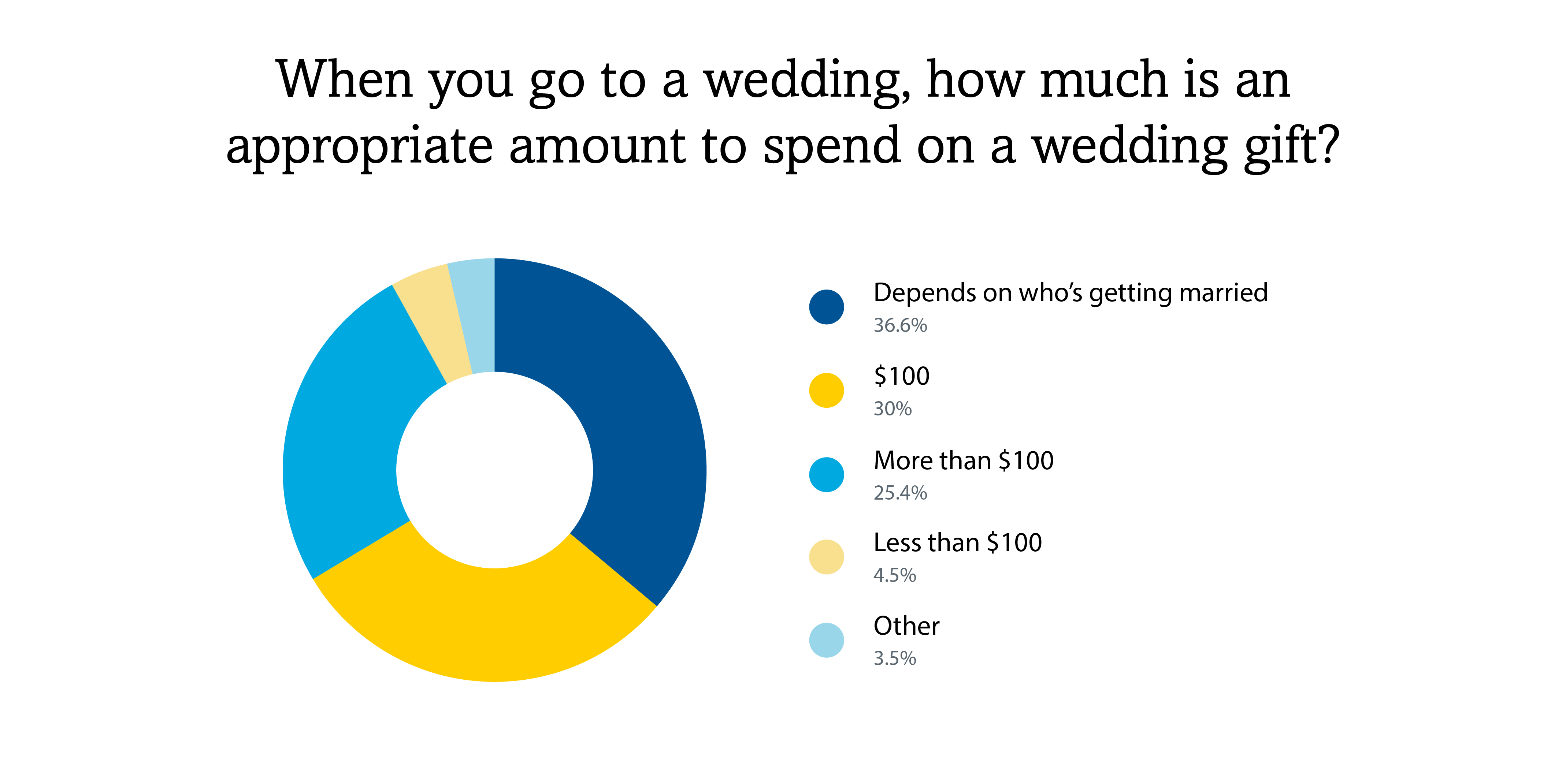

How much should I spend on a wedding gift?

The general consensus from our survey is that about 55% of respondents believe spending $100 or more per guest is appropriate for a wedding. However, nearly 40% reported that it entirely depends on who is getting married.

A sibling’s wedding versus a coworker’s wedding, for example, likely warrant different degrees of gifting. But regardless of who you’re buying that gift for, let’s not overlook the expected cost of the gift: $100 or more. This can be challenging for folks on a strict budget.

If you’re concerned about how much you can feasibly put toward gifts this wedding season, open a separate savings account and put money aside incrementally once you RSVP to the event. This will help ensure you have enough cash for the big day and its associated activities.

Pro Tip: If you use direct deposit, you can allocate a specific amount of your paycheck to be automatically deposited in that special savings account. Saving a little over time can help take the sting out of spending a large amount all at once.

How to Afford Your Best Friend’s Wedding

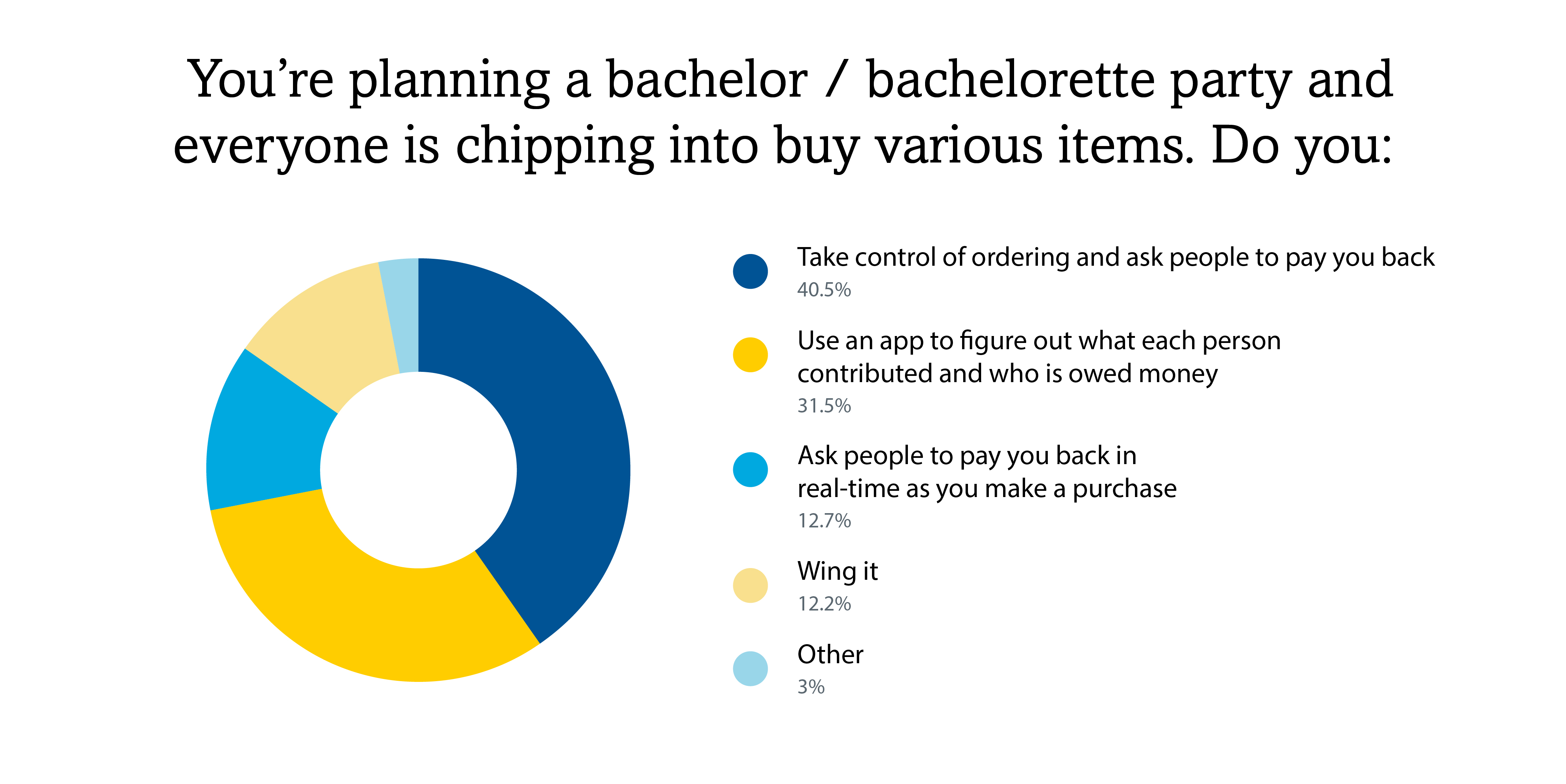

How do I split the bill for a bachelor or bachelorette party?

One thing’s for sure – these survey respondents are go-getters! Over 40% of respondents said they’d take control of spending and ask people to pay them back down the line. While this might make purchases quicker, it’s easy to lose track of all the transactions from an entire weekend. That might be why 31% of respondents said they’d use an app to figure out what each person contributed and who is owed money.

Don’t feel pressured to wing it or coordinate payments in real time. You’re using your phone to document the whole weekend, so why not document transactions too? Free apps, like Splitwise and Bach App can help your whole group keep track of accumulating costs. You can name a transaction to stay organized, and can initiate easy transfers to your bank account.

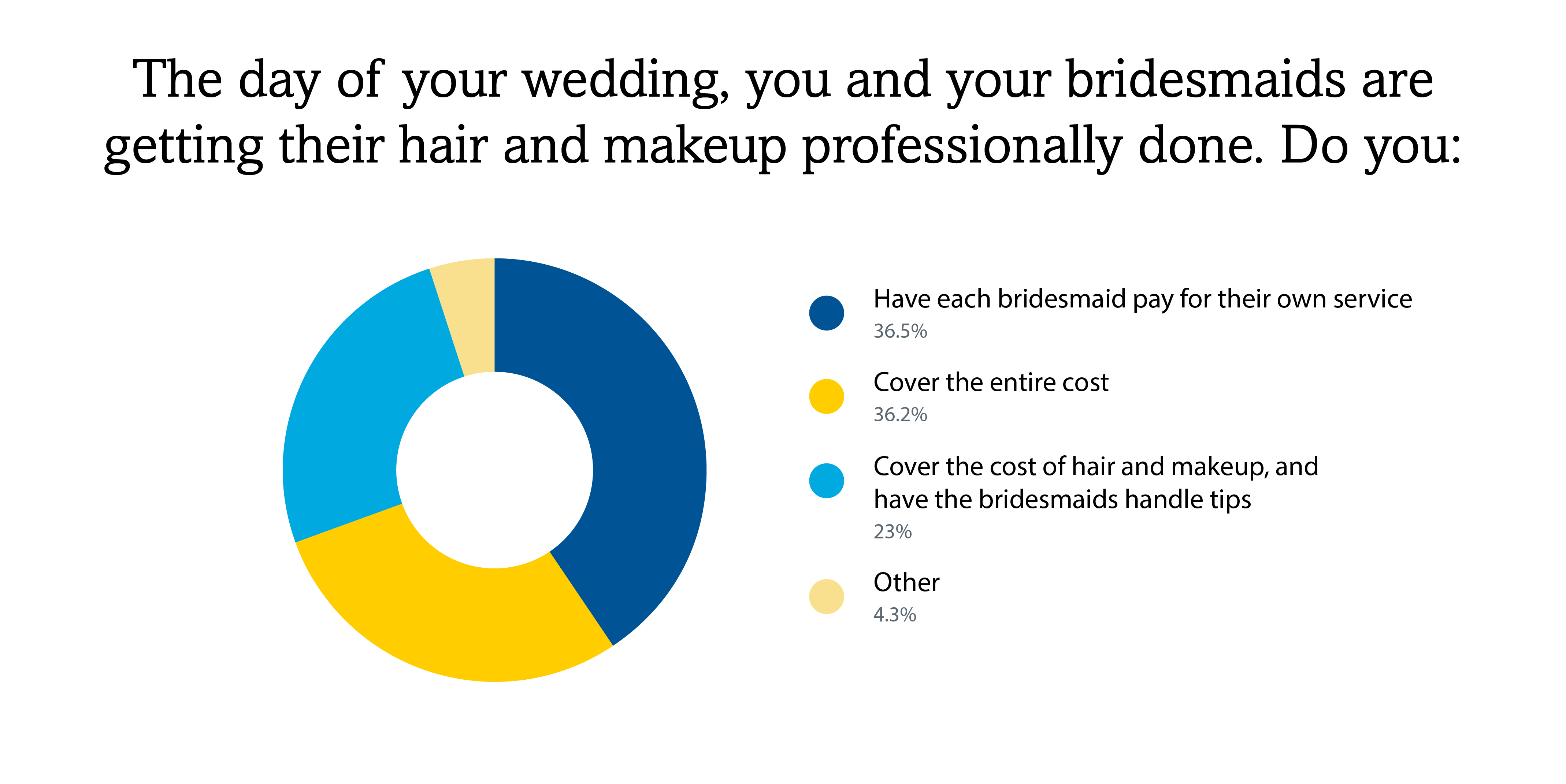

Should the bride cover hair and makeup for the bridal party?

Interestingly, the top two choices were opposite each other! Customers surveyed were in a near split between the bride covering hair and makeup, and bridesmaids paying for their own service.

There’s no doubt everyone wants to look their best for the big day, but by the wedding date, costs have likely added up for the entire wedding party. For many, an additional $100 per bridesmaid can push strained budgets too far.

Whether the bride plans to cover the service for their wedding party, or bridesmaids need to cover the cost themselves, it’s best to plan early and be transparent about expectations. That way, if guests need to pay for their own service, they can budget accordingly ahead of time.

Pro Tip: A common practice many people who are part of a bridal party now experience is having a survey sent to the whole party with questions of how much people are comfortable spending for various activities such as dresses, hair/makeup and bachelorette party.

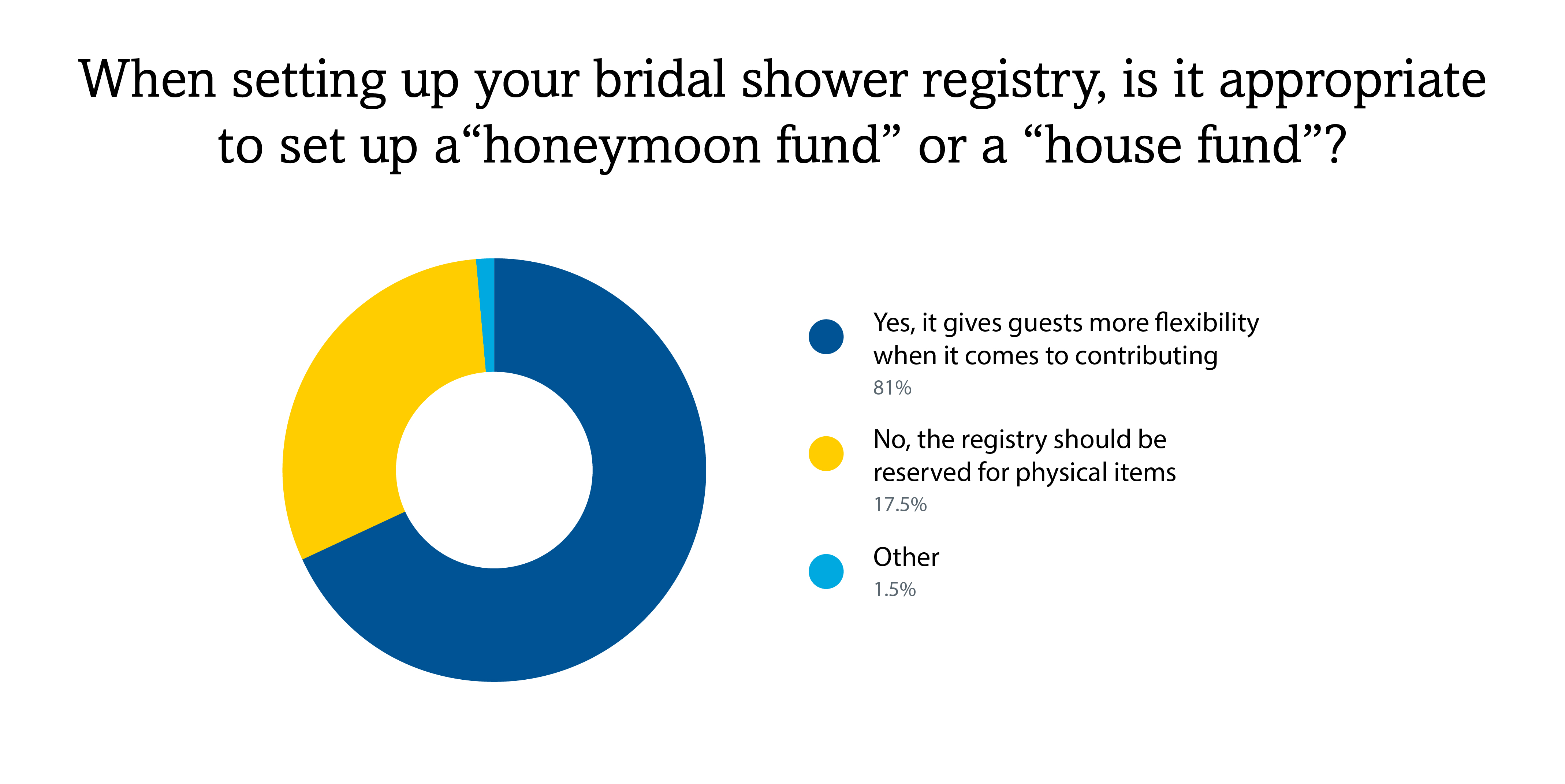

Is it okay to list a “honeymoon fund” or a “house fund” on my bridal shower registry?

If we asked this question 50 years ago, we probably would have received a very different set of responses. And that’s because, well, times are changing! Three-quarters (76%) of recent marriages (2015-2019) were preceded by cohabitation, compared to only 11% of marriages between 1965-1974.

With more couples living together prior to their wedding day, many of them already own the traditional items that go on a wedding registry, like that Kitchen Aid Mixer you’ve had your eye on. This is one of the main reasons why it’s more common for couples to go the “honeymoon” or “house fund” route as opposed to physical items. With this in mind, you might want to skip the turbo blender and put money toward their next stage of life.

Pro Tip: Do what you’re most comfortable with. If your preferred method for bridal shower gifting is to wrap and bring a physical gift, by all means, go for it!

6 Housing Market Trends to Watch in 2025

Should I have an open bar at my wedding?

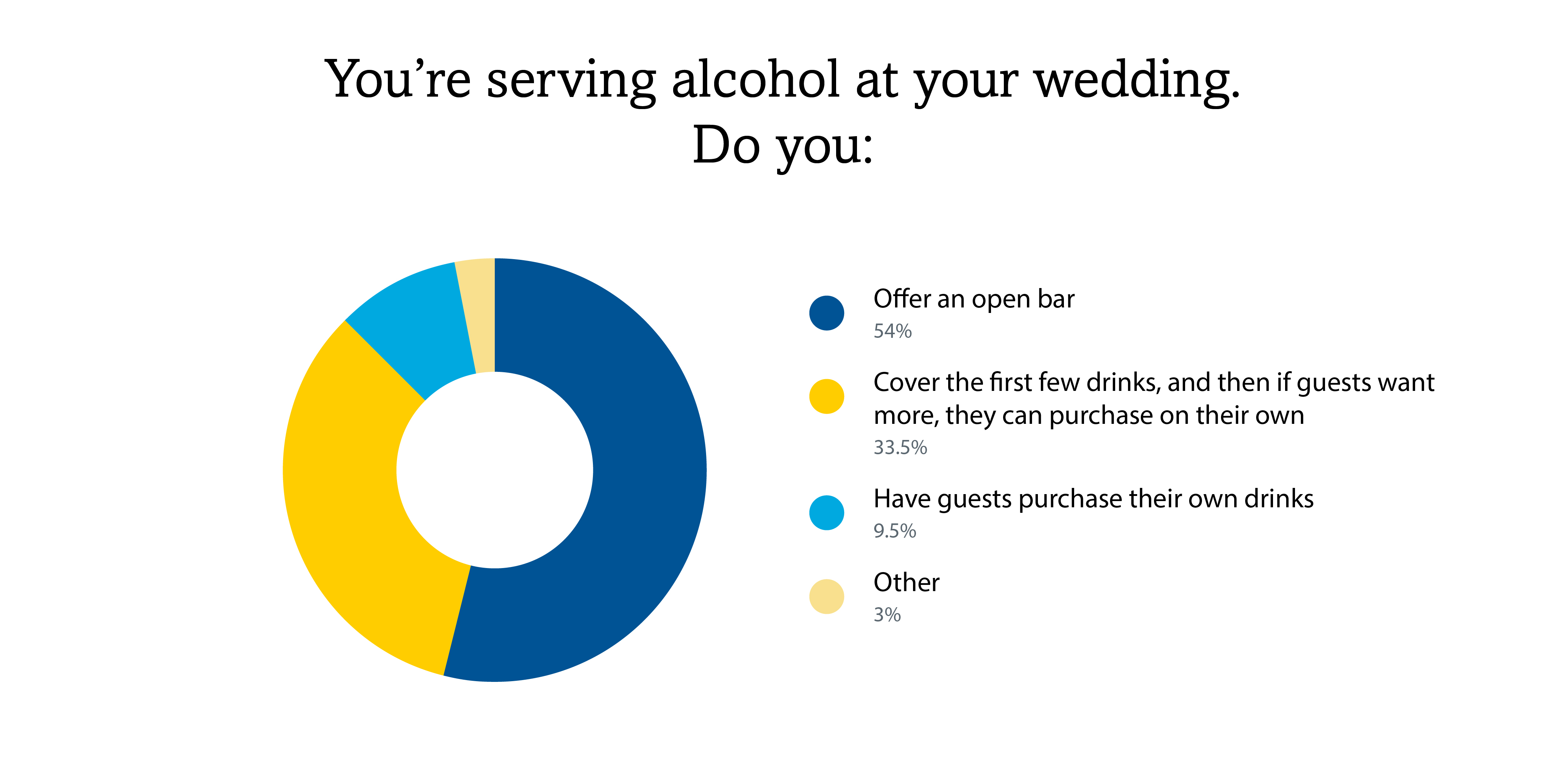

Salute! Nearly 90% of respondents said the happy couple should cover at least a portion of adult beverages served, if not the entire cost. But a variety of factors can make this easier said than done.

The number of guests can be a make or break for this decision. If you’re on a tight wedding budget, you may not want all 300 guests racking up the bill. Once the guest list is finalized, you’ll have a better idea of what’s possible for your budget. If your guest list ends up longer than anticipated, it may make the most financial sense to skip the open bar. Check out The Knot’s wedding alcohol calculator to help determine the best course of action – it takes reception duration, head count, and alcohol type all into consideration!

One other factor to keep in mind as you determine whether or not an open bar makes sense for your wedding is lodging. If guests are not spending the night near the wedding location, it may make sense to cover the first beverage and have guests purchase from there. That way, your loved ones have the option to celebrate with a drink while still getting home safely.

But open bar or no open bar are not the only options to consider. Some survey participants suggested the newlyweds cover beer and wine, and guests purchase hard liquor drinks if they please.

Prioritize your budget

Every wedding is unique, just like every budget. Whether you’re planning the special day or simply attending one, prioritize decisions best suited to your situation. Your loved ones want the best for you, so don’t feel obligated to risk your financial well-being for one event.

We loved reading these survey responses, and we want to hear more from you! Tell us what surveys you’re most interested in seeing next, and sign up to receive them as soon as they’re live.