Written by Steve Andrews

As Clear as Mud

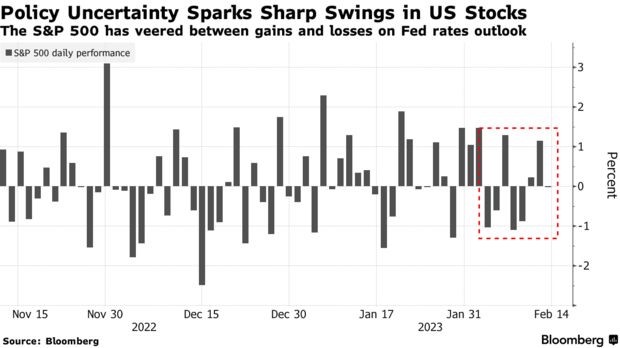

At mid-February, the S&P 500 was up 7.7% over the first 7 weeks of 2023 – nice progress, however the ride has been anything but smooth as the markets remain petrified over what the Fed might do. Is good economic news really “good”? Or is it bad for the markets because it may force the Fed to get even more aggressive in hiking rates?

In January, US employment enjoyed a 517,000 increase in non-farm payroll jobs which helped lower the US unemployment rate to 3.4% (a level that hadn’t been touched since 1969), along with a 3.0% jump in Retail Sales and a 5.6% surge in Durable Goods Orders.

On the flip side, the Leading Economic Indicators (LEI) index from The Conference Board has been in steady decline for the past 10 months, and housing continues to struggle (even though total real estate borrowing and lending was up 2% in December, and up over 11% for all of 2022).

As markets try to determine what is real and what isn’t, you can forgive Investor sentiment from swinging back and forth like spectators’ heads at a tennis match. Sentiment and stock prices will surge one way from an economic report, then both will quickly snap the other way as worries surface over how the Fed will react to the good news.

Impacts of the Fed

It’s not all that clear to us that the Fed deserves all that fear and awe. The 8 Fed rate hikes through January, which brought short-term US rates (Fed Funds, LIBOR, SOFR, etc.) from near-zero to well above 4.50%, have had little impact on lending, spending, or borrowing to date. This offers us a good reminder that the Fed can target borrowing by raising or lowering the Fed Funds rate, but the markets will always and everywhere have their say in how the economy responds.

Both consumer and producer prices (CPI & PPI) rose more than expected in January, which panicked investors once more but, overall, prices continue to moderate. The most recent update on the Fed’s preferred measure of inflation, Personal Consumption Expenditures (PCE) shows that they have been running at just a 2.1% annualized rate over the last 6 months of 2022 – practically on top of the Fed’s target rate of inflation. Still, the Fed is worried that the strong labor market, with 11 million job openings, will boost wages and keep inflation running well above their 2.0% target. However, from where we sit, inflation is trending lower, and wages typically follow inflation - not the other way around. If you recall when we were clawing back from the Great Recession, there was a lot of concern that the American worker was falling behind – that wages weren’t keeping up. However, a look at inflation (CPI) from 2012 – 17 shows that CPI growth was averaging just 1.2%. Over that same time span, wage growth averaged 2.2%. Low inflation keeps a lid on wages, while rising prices force companies to pay their employees more.

This divide offers hope that the bearishness in the markets that characterized 2022 is giving way to a more balanced view on the economy. Since most investors tend to look ahead to where the economy (and profits) might be over the next 6 to 24 months, it suggests that, while the road is rocky right now, more and more investors are expecting that the road could smooth out later this year.

In Conclusion

Of course, a recession is still possible. The effects of the steep rate hikes over the past 12 months are still working their way through the economy. Whether the Fed goes overboard and somehow chokes economic growth to recession levels remains to be seen, but we’ll put our money on a “data dependent” Fed, which will back off if the economic data warrants (it doesn’t yet) and will stay tough if disinflation falters and inflation rebounds.

For the time being, expect the Fed to hold rates steady. They may or may not repeat February’s quarter-point (0.25%) rate hike at the next FOMC meeting on March 22 - a lot of data will emerge between now and then - but it’s doubtful that they will pivot and reverse their course for monetary policy and cut rates before the year is out. What we’re left with is a poor man’s “Goldilocks” economy with resilient, albeit tepid, growth amid slowly moderating inflation. Things could be better, but they certainly could be much worse.

.png)