Interest Rates 101: A Business Owner's Guide

Two things are certain in life: death and taxes. Notice there’s no mention of interest rates? That’s because they are anything but certain.

Whether you're considering a loan for new equipment or refinancing an existing debt, understanding interest rates and how they affect your business can help you make more informed financial choices − benefiting your bottom line. Let’s break it down.

What Are Interest Rates?

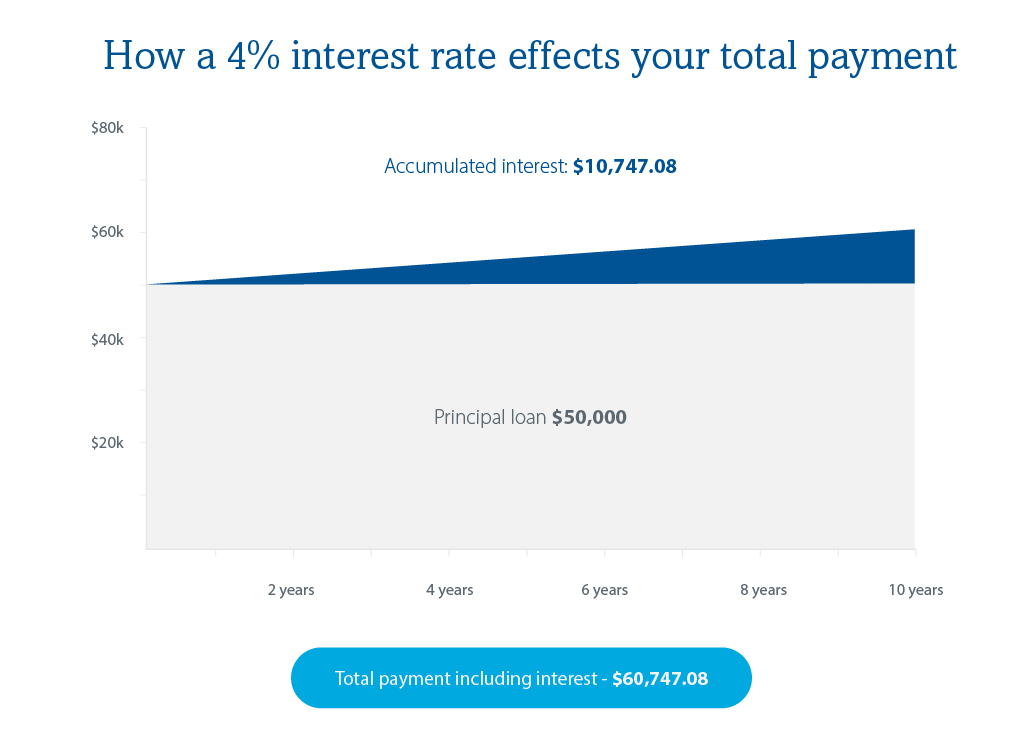

When your business borrows money from a financial institution like a bank or credit union, there’s a cost associated with it: the interest. Expressed as a percentage, the interest rate determines how much you'll owe on top of the principal loan amount, which is another way of saying the original sum of money borrowed. Keep in mind that interest rates are quoted based on an annual percentage rate (APR) basis, or the percentage you’d pay over one full year.

Note that the highlighted interest rate of 4% is not representative of the latest interest rates offered by Rockland Trust. Please inquire with a Banker to learn more.

How Are Interest Rates Set?

While your specific interest rate is set by the institution you borrow from, the Federal Reserve (often referred to as "The Fed") influences broader economic conditions.

The Fed sets target rates that lending institutions generally follow, known as the Fed Funds Rate. This plays a key role in driving economic activity, either stimulating it or slowing it down. In general, when the economy is performing well, interest rates tend to rise.

It’s important to note that interest rates change over time. When the Federal Reserve changes its interest rate, it usually affects short-term rates right away. Long-term rates, on the other hand, don’t usually change immediately because they are based on different reference points.

Many lenders in New England use a rate set by the Federal Home Loan Bank of Boston. The lender then adds an extra amount to this rate to calculate the final rate the customer will pay.

Understanding Fixed-Rate vs. Variable-Rate Loans

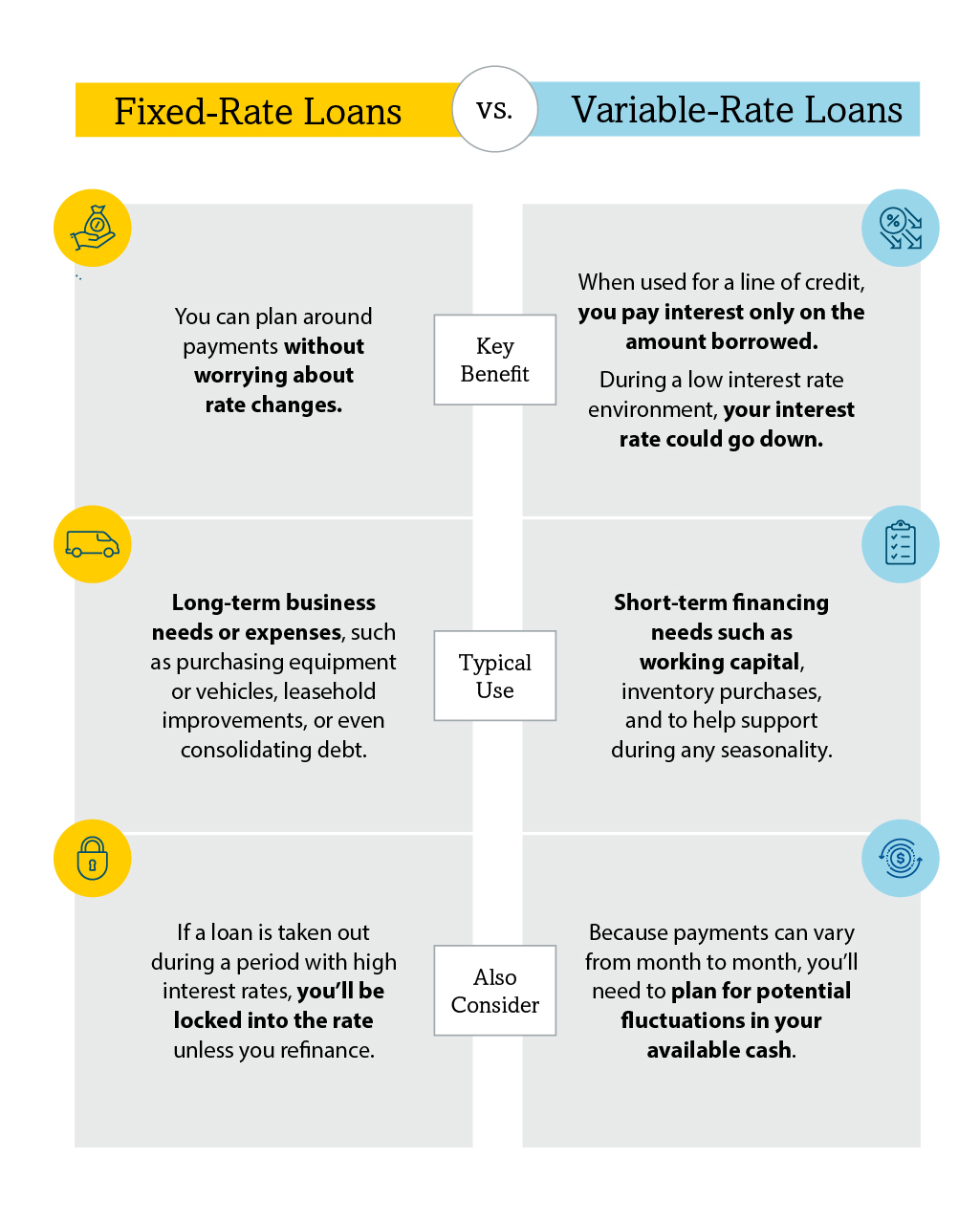

Generally speaking, there are two types of interest rates, a fixed interest rate and a variable (or adjustable) interest rate.

Tips to Protect Your Business from Changing Interest Rates

It’s a good idea to meet with your banker or financial advisor to go over all of the products you’re in and the current rate(s) you’re paying to better understand your business’s full financial picture.

Here are a few more things to think about to protect your business in a time of changing rates:

Finally, if you’re unsure of the best strategy for your business, consult a Rockland Trust Bank advisor who understands your business banking needs.