Do you have money on the sidelines, but are unsure if now is the right time to invest? To take the emotion out of this decision, many recommend the concept of Dollar-Cost-Averaging (DCA). DCA is an investment strategy in which equal dollar amounts are invested in the market at regular time intervals for long-term growth. You may not know the term but are familiar with the concept. It is commonplace with respect to retirement savings, executed via systematic payroll deductions. That payroll deduction is then invested each period, allowing us to accumulate wealth over time. As with any investment strategy though, there are pros and cons to each approach.

What stage of life you are in and what you are trying to achieve, among other factors, will dictate what investing approach is best suited for you. A DCA strategy may be especially relevant to those with limited future income sources and limited market exposure who are considering investing a significant portion of their assets. However, if you compare a DCA investment strategy to that of investing a lump sum all at once, dollar-cost averaging may provide more peace of mind, but this comes at a higher cost and with little benefit over a longer investment period. The concept of a DCA approach has some appeal, but it turns out that while it may provide an emotional benefit (mitigate the inherent fear of starting to invest at a market peak), it rarely provides a financial benefit.

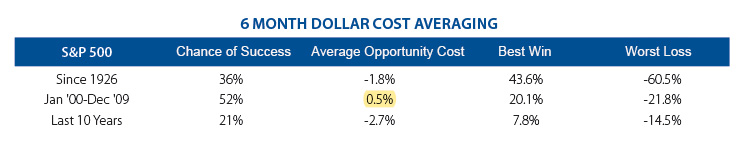

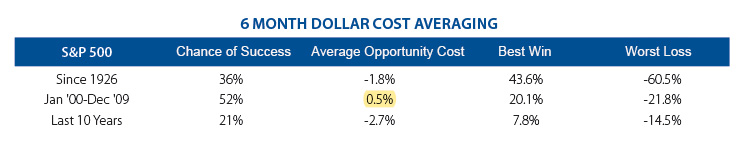

To put things into perspective, let’s review the data over time and quantify the results of using a dollar-cost averaging strategy relative to investing your money all at one time. Below are the results of a six month dollar-cost averaging strategy implemented over three periods in market history and the success relative to a lump sum investment.

What we see is that a dollar-cost averaging approach only results in a better outcome than putting the money to work all at once if the investment declines at some point during the period. In other words, it won’t cost as much if you buy into the market when it is down. The challenge is stocks have an inherent upward bias over time, in other words in the long run the market moves higher. The longer the period examined, the more likely that appreciation will occur. This means that if you are averaging into a position over a long time, you may not do as well as if you had simply invested a lump sum at the beginning of the period considered. Said another way, odds are it will cost you more to buy into the market during the predetermined set intervals because the market tends to move higher in the long run. Alternatively, your chances of avoiding the increased cost by investing it in a lump sum are greater.

Reviewing the table, since 1926, the odds of a six-month DCA strategy producing more favorable results is only 36%, and the average opportunity cost for a 6-month period is 1.8%. In the last decade, the odds of DCA success are only 21%, with an expected cost of 2.7% for the period. Not surprisingly, DCA had a better than a coin-flip chance of working in the S&P’s worst decade (2000-2009), which includes both the tech bubble bursting and the financial crisis. Even so, the average gain was only 0.5%.

Historically, during market extremes like the 1932 Great Depression where the market fell almost 50% in three months before fully recovering that summer, a dollar-cost averaging approach would have saved the investor more than 43%. Yet one year later, the same exercise of systematically entering the market over six months would have left an investor 60% behind a lump sum investing approach at the beginning. More recently, if one averaged into the market over six months prior to March 2009, the investor would have saved 20%. Conversely, if you started a six month DCA program in March 2009 you would have lagged 22% behind the lump sum investor as the bull market rally had begun. Timing the market is extremely difficult.

Although mathematically the odds are stacked against dollar-cost averaging working, it can be beneficial it certain circumstances such as when the market trends lower during the purchase phase or the investor is seeking assurance and comfort lessening the blow if bad things happen. DCA is essentially an insurance policy against an extreme event which is difficult to predict and whose “premiums” will be paid without ever "filing a claim".

Establishing an investment plan appropriate for your goals and sticking to it is more important than trying to pick the perfect entry point. The investment allocation selected is more critical to long-term success than selecting the perfect day to begin.

Not Insured by FDIC or Any Other Government Agency / Not Rockland Trust Guaranteed /

Not Rockland Trust Deposits or Obligations / May Lose Value